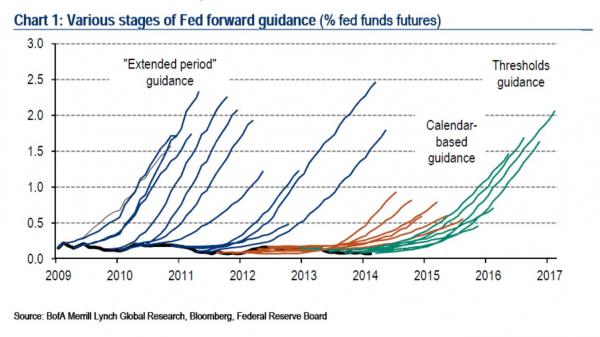

The chart below, which summarizes 5 years of Fed “forward guidance” on that most critical of variables – the Fed Funds rate – proves two things:

i) there is nothing worse in this world than being a Fed Funds, or Eurodollar, trader, considering 5 years of forecasts have been systematically destroyed by a Fed which has failed time and time and time again to stimulate the economy enough to push it away from ZIRP (and why any hope for the first rate hike in mid-2015 are idiotic), and

ii) when it comes to central planning, the economists that now openly control the bond and stock market and increasingly more of global capital flows, have absolutely no idea what tomorrow brings perversely, since it is their actions that have made the required outcome – a self-sustaining, economic recovery – impossible.

And some amusing cover from Bank of America to justify this disaster:

In each of the last three business cycles, the market consistently mispriced the Fed, expecting rate hikes much too early. Let’s take a look at the forward curve after each FOMC meeting in the most recent period. Until the Fed announced “calendar guidance†in 2011, the markets always saw Fed rate hikes just around the corner. More recently, Fed attempts to guide the markets have flattened that curve.

So… is this Bank of America’s attempt to validate curve flattening (and soon inversion) as bullish? Sure, why not.