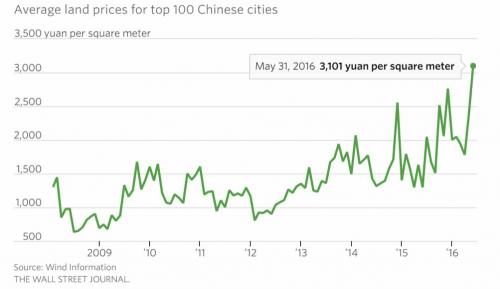

The saying goes “when in a hole, stop digging.” In China, conventional wisdom appears to be flipped on its head as follows: “when facing a massive real estate bubble, keeping blowing.” That is the case at least according to the following chart showing the average price of land, the main ingredient of the property world, in the top 100 Chinese cities, which as of May has hit a record 3,100 Yuan per square meter.

Â

As the WSJ calculates, the average land price per square meter for the top 100 Chinese cities in the first five months of this year jumped nearly 50% from same period last year, citing Wind Information. More stunning is that according to Wind, some land prices are even higher than asking prices for fully-built houses nearby.

You read that right: unbuilt land in many places in China now costs more than fully-finished apartments.

Some examples of how the government itself, through SOEs, is pushing the real-estate bubble on a parabolic path that will lead to an unmitigated bubble explosion.

- State-owned developer Poly Real Estate bought a piece of land in a Shanghai suburb for 5.5 billion yuan ($835.5 million) last month. This translates to roughly 44,000 yuan per square meter of buildable space.This is more than what full-built houses in the region sell for, with the average price at around 40,000 yuan per square meter. After taking into account construction costs, taxes and other expenses, property prices would have to nearly double for the developer to make money.

- A property subsidiary of China Gezhouba Group, a state-owned builder of power plants and dams, spent 3.3 billion yuan last month to buy the most expensive land, in terms of price per square meter, in Nanjing. Another state dam construction company, Power Construction Corp. of China, snapped up a piece of land in China’s bubbliest property market, the southern metropolis of Shenzhen, for 8.3 billion yuan.

- Cinda Real Estate, a subsidiary of state-owned “bad bank†China Cinda Asset Management, has splurged on at least 35 billion yuan of land over the past year, even though the market value of the company, listed in Shanghai, is just 7.3 billion yuan.