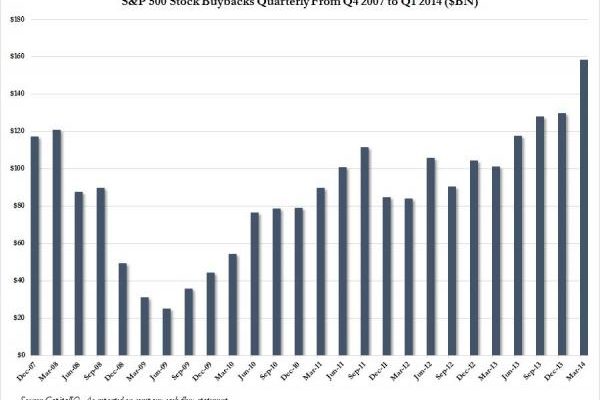

While we have yet to do the actual math on the now-concluded second quarter earnings season, to find out if spending on buybacks surpassed the Q1 record, one thing is still quite clear: with the impact of Fed’s QE fading, if only for the time being, buybacks remain the marginal driver, and according to some only driver, of stock market upside in 2014. This was shown explicitly in this chart we posted three months ago:

Â

However one person who has decided not to wait in declaring the buyback party over, is SocGen’s Albert Edwards, the same person who correctly forecast back in late 2012 the epic scramble by investment grade (and high yield) companies to lever up, incidentally, to record levels crushing all the endless blather that there is some massive corporate deleveraging going on.

This is what Edwards said in his latest note:

Much has happened over the summer, but two landmark firsts have occurred only recently, with the S&P500 breaking above 2,000 and the 10y bund yield breaking below 1%. Our Ice Age thesis has long called for sub-1% bond yields and I see this extending to the US and UK in due course. It is the equity markets where I have been consistently surprised. QE has been an essential driver for the equity market, providing the fuel for the heavy corporate bond issuance being used for share buybacks. Companies themselves have been the only substantive buyers of equity, but the most recent data suggests that this party is over and as profits also stall out, the equity market is now running on fumes

In other words, while QE has been the permissive factor enabling companies to engage in zero cost debt-funded stock repurchases, it was corporate CFOs and Treasurers who, in lieu of traditional retail and institutional buyers, have been the marginal buyers of stocks in the tail end of the most ridiculous, rigged, and as CNBC likes to call it, “unloved” rally of all time.

Here is the bad news: