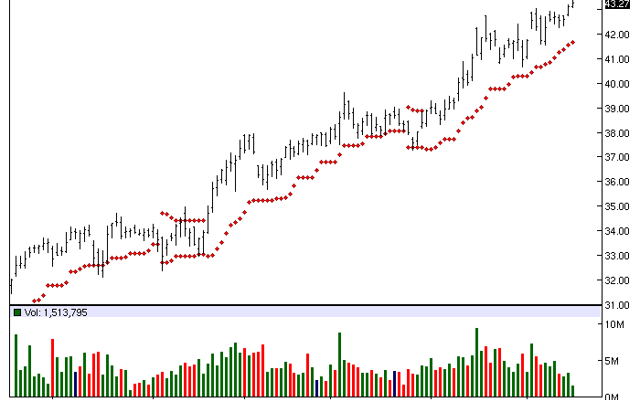

The Blackstone Group (NYSE:BX) is the Barchart Chart of the Day. The investment management firm has a Trend Spotter buy signal, a Weighted Alpha of 52.40+, gained 48.99% in the last year and paid an 8.36% dividend yield.

The Chart of the Day belongs to the Blackstone Group . I found the stock by sorting the All Time High list for the stocks with the highest technical buy signals, then used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 3/31 the stock gained 11.34%.

Blackstone is one of the world’s leading investment and advisory firms. Their alternative asset management businesses include the management of corporate private equity funds, real estate funds, funds of hedge funds, credit-oriented funds, collateralized loan obligation vehicles (CLOs) and closed-end mutual funds. The Blackstone Group also provides various financial advisory services, including mergers and acquisitions advisory, restructuring and reorganization advisory and fund placement services.

The status of Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 6 new highs and up 5.58% in the last month

- Relative Strength Index 69.40%

- Barchart computes a technical support level at 42.52

- Recently traded at 43.29 with a 50 day moving average of 40.19

Fundamental factors:

- Market Cap $23.09 billion

- P/E 9.61

- Dividend yield 8.36%

- Revenue expected to grow 10.20% this year and another .30% next year

- Earnings estimated to increase 8.20% this year, decrease by 5.40% next year and decease annually at a rate of 2.22% for the next 5 years

- Despite these negative forecasts Wall Street analysts issued 5 strong buy, 9 buy and 1 hold recommendation