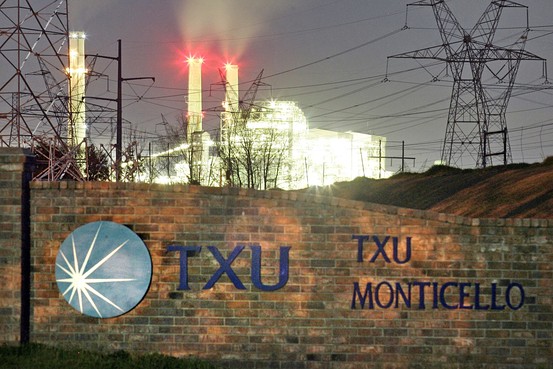

The bankruptcy of Energy Future Holdings, aka TXU, aka the largest LBO ever has been long in coming. As we previewed it most recently in September of last year, “if there was one deal that epitomized the last credit bubble, aside from the Blackstone IPO of course, it was the ginormous, $45 billion 2007 LBO of TXU, now Energy Future Holdings. And while the tide for the New Abnormal credit bubble has yet to expose its megalevered monoliths swimming fully naked, as for now corporations have opted for graduated semi-MBOs in the form of ever larger stock buybacks, the time to pay the piper for the last credit-fuelled binge has arrived and inevitable bankruptcy of this landmark deal is now just days away.”

It turned out it was more like months away, but it finally arrived, and moments ago, TXU finally succumbed to (lack of) cash flow reality, when it filed for a prepackaged Chapter 11 bankruptcy on Tuesday morning after months of negotiations with creditors aimed at speeding the restructuring of the private-equity backed utility’s debt load of more than $40 billion. While it is unclear just how much total debt the company will ultimately restructure, it is likely that the final number will be greater than Enron’s, making this also the largest ever non-financial bankruptcy in history.

As we further previews a year ago, “the losers (in addition to the thousands of company employees who were and are about to be laid off): all those who invested equity in hopes nat gas prices would rise, and even looser credit would mean a quick and profitable flip in the next 3-5 years, namely KKR, TPG, as well as Lehman (RIP), Citigroup, and Morgan Stanley. These banks were also instrumental in underwriting (and holding on to) the loans and bonds that would fund this monster deal, which ultimately led to unprecedented writedowns for all those involved. The irony: the same companies that provided the LBO financing, will also now serve as the source of the company’s $2+ billion DIP loan, so all is well with the world.”