Finding companies with 3%+ dividend yields, sustainable payouts ratios, and long histories of raising their dividend payments is difficult. Companies with one of these traits is easy – but it’s the combination of factors that makes these investments rare.

Now what if I told you there was an entire group of companies that satisfied these criteria? The group of companies I’m referring to is the ‘Big 5’ Canadian banks, which consist of:

- The Royal Bank of Canada (RY)

- The Toronto-Dominion Bank (TD)

- The Bank of Nova Scotia (BNS)

- The Bank of Montreal (BMO)

- The Canadian Imperial Bank of Commerce (CM)

With their high dividend yield, strong dividend growth history, and reasonable payout ratios, these banks all rank favorably using the 8 Rules of Dividend Investing. Further, most of these banks are members of the Canadian Dividend Aristocrats Index – a group of elite Canadian companies with 5+ years of consecutive dividend increases.

This post will analyze the investment prospects of one bank in particular – BMO.

BMO was also the last of the Big 5 to report their earnings, with the announcement coming on December 6th. This post will analyze that earnings release in detail.

Business Overview

Like the rest of the Big 5, BMO is an integrated financial services provider with operations in retail banking, wealth management, commercial banking, and capital markets. For reporting purposes, the Bank divides their operations into three segments:

- Personal and Commercial Banking

- Wealth Management

- Capital Markets

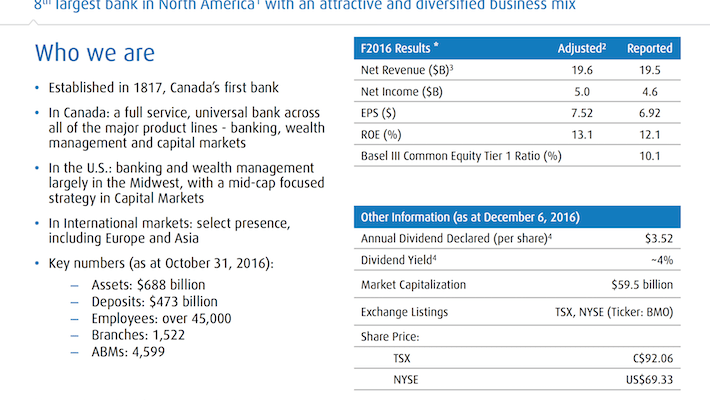

The Bank describes their operations in more detail with the following slide.

Source: BMO Investor Presentation

As you can see, the Bank has a very large operational scope, and is a very old business (established in 1817). With 45,000 employees, 1,500+ branches, and 4,500+ ABMs, BMO is the 8th largest bank in North America as measured by assets and the 4th largest in Canada.

However, that doesn’t mean the Bank is a slow-moving, slow-growing business. Rather, BMO has identified five strategic priorities to secure the future of their business, which they outline in the following slide.

Source: BMO Fourth Quarter Investor Presentation

BMO also has a significant presence in the United States, where they operate as BMO Harris Bank. This segment of the Bank’s operations should be a key driver of future growth, and will be outlined in more detail later in this article.

Financial Performance

On December 6, BMO reported earnings for the three-month and one-year period ending October 31, 2016. Their quarterly results are summarized as follows, with comparisons being made to the same quarter one year ago:

- Net income of $1,345 million, up 11%

- EPS of $2.02, up 10%

- ROE of 13.8%, compared with 12.9%

- Common Equity Tier 1 Ratio of 10.1%

On an adjusted basis, the results are very similar:

- Adjusted net income of $1,395 million, up 10%

- Adjusted EPS of $2.10, up 11%

- Adjusted ROE of 14.4%, compared with 13.5%

To top off these fantastic quarterly results, BMO also increased their quarterly dividend payment from $0.86 to $0.88 per share.

In the same press release, BMO also reported earnings for fiscal 2016. They are summarized in the following table.

Source: BMO Fourth Quarter investor Presentation

A few key highlights:

- Net revenue increased by 8% on an adjusted basis and 8% on a reported basis.

- Net income increased by 7% on an adjusted basis and 5% on a reported basis. Adjusted net income of $5,020 million is the most in BMO’s history.

- Diluted EPS increased by 7% on an adjusted basis and 5% on a reported basis.

- Common Equity Tier 1 Ratio of 10.1% is well-above the Basel III requirement of 6%.

All in all, the announcement was well-received by BMO’s investors, with the stock price jumping post-announcement. And it’s no surprise why – the Bank delivered strong growth in a number of key business metrics.

Moving on, I’m now going to cover the investment prospects of Canada’s fourth-largest bank. My investment thesis will center on the following topics: