Oh dear the Bank of England seems to have seriously lost the plot. So today it announced a rate cut from 0.5% to 0.25% and yes it is back to money printing increasing its Quantitative Easing programme by a further £70 billion including possible corporate bond purchases. This is a really dangerous policy as it shows the Bank of England is just going to keep printing cash whenever the UK is in trouble. This undermines confidence and penalizes savers and hits bank profitability. It also just leads to a further misallocation of credit and even by the banks own forecast will push inflation above its 2% remit to 2.6%. Also they were divided on the QE programme (6 for and 3 against) and this will not go down well in the foreign exchange market.

It seems like panic when in fact we need financial stability to rebuild confidence after the disastrous Brexit vote. The way forward is not more fiscal expansion and certainly not more monetary easing but a focus on supply side reform. This would include massive tax reform and simplification, an end to non means tested benefits – I know professors on good salaries getting free travel in London aged 60 what a joke ! An end to the absurd “triple lock” on pensions, less bureaucrats and more front line and better investment in education and training and other measures to improve productivity.

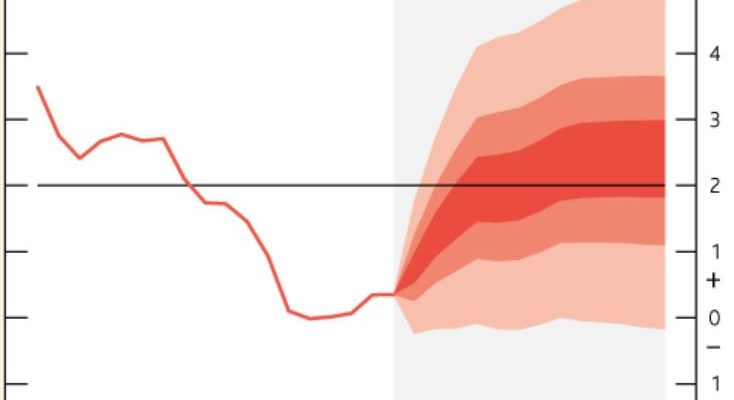

Below are the latest inflation and GDP forecasts from the Bank of England.