The four money center banks in the US have been the source of much investor and media attention in the years since the Great Recession. The group suffered mightily at the hands of the worst economic downturn in decades and two of them were brought to the brink of insolvency as a result.

Finance stocks in general suffered during the Great Recession, but many have fully recovered – and then some.You can download the full list of all 1,000+ dividend paying financial sector stocks below.

In addition, these once-strong dividend stocks were reduced to smaller payouts for years, but are in the process of restoring those shareholder distributions; some have made better progress than others.

However, the past decade has rejuvenated the group and in this article, we’ll rank them in order of attractiveness on a total return basis, as derived from our Sure Analysis database. Rankings are compiled based upon the combination of current dividend yield, expected change in valuation as well as forecast earnings-per-share growth to determine which stocks offer the best total return potential for shareholders.

Read on to see which of the four biggest US banks ranks as the most attractive for investors today.

Big US Bank #4: JPMorgan Chase & Company (JPM)

JPMorgan Chase can trace its lineage back to 1799, making it one of the oldest surviving banks in the US. The company has a strong global reach in consumer and community banking, commercial and investment banking, as well as asset and wealth management. JPM focuses heavily on consumer lending via its huge mortgage, auto and credit card loan operations, but has a vibrant mix of non-lending activities as well. JPM is the product of more than 1,200 different entities that have merged in the 219 years since its creation and is the largest bank in the US by market cap, as JPM’s market value is in excess of $370B.

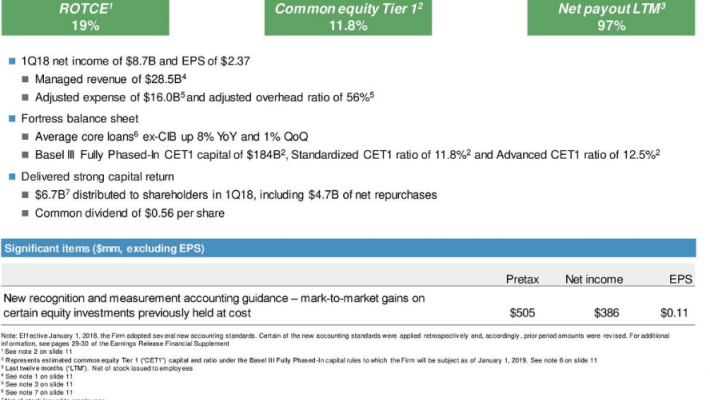

JPM is widely considered the benchmark for other large banks in terms of its revenue diversification, tremendously strong balance sheet and sizable capital returns to shareholders. That strength and perceived best-of-breed status has led to the stock being more robustly valued than the rest of the group in recent years, meaning it is now slightly less attractive for value investors. However, stellar results continue to come in, as evidenced by its recent Q1 report.

(Click on image to enlarge)

Source:Â Q1 Earnings Slides, page 1

Q1 highlighted the favorable trends that JPM has continued to see in its results in recent years, the product of world-class leadership and strong stewardship of shareholder capital. EPS rose 37% excluding a one-time gain as lower provisions for loan losses and higher core loan balances helped JPM produce higher earnings. JPM’s overhead ratio remains in the mid-50% range, which is fairly strong for a large bank, but there is certainly further room for improvement going forward. Pre-crisis overhead ratios were sub-50% during the boom years and while we may not see them that low again – due to increased regulatory oversight costs and heightened scrutiny from regulators in terms of revenue generation – JPM still has that lever to pull going forward.

JPM’s profitability is already exceptional at 19% return on tangible common equity, or ROTCE, which is part of the reason why investors have valued it so richly. It also compares quite favorably to the 13% ROTCE JPM achieved in last year’s Q1. However, as terrific as its current level of profitability is, as measured by ROTCE or any other measure, that leaves very little room for growth going forward from profitability improvements on a large scale. JPM has some upside potential here but as it is further along than the other banks, its growth potential from here is rather limited.

JPM’s balance sheet remains among the best in the business as it came through the Great Recession as an acquirer and in better shape than it was prior to the downturn. JPM has built upon that strength and its fortress balance sheet principles in recent years, as Q1 was yet more evidence the strategy is working. Common Tier 1 Equity was 11.8%, right in line with where it has been for years at this point. The big banks are in a constant balancing act in terms of investing capital and saving it as the former allows for growth but the latter is required for a strong balance sheet. JPM’s balance sheet is tremendous but don’t look for sizable improvements going forward; like its profitability, JPM’s balance sheet is already outstanding.

The bank’s dividend was slashed during the crisis of course, but payout growth in recent years has been very strong, affording JPM a 2% yield at present despite an enormously bullish run in the stock price. JPM’s dividend will continue to grow handsomely in the years to come as its payout ratio is still very low indeed, and we see the yield therefore approaching 3% in the next few years.

JPM’s earnings outlook isn’t as bright as the other big banks because its profitability is already excellent, it has a lot of leverage to the flattening yield curve via its enormous consumer and commercial lending operations, and its credit card portfolio is huge as well, accounting for nearly half of its revenue in the flagship community and consumer banking business. Credit card losses have surged in recent quarters as credit quality has come off of unsustainable highs. This has been a problem for all credit card lenders but given JPM’s sheer size in the space, the damage is more acute.