Most Americans don’t know, but the housing market is heading toward another epic bubble. However, the bubble forming today is much different than the subprime housing meltdown in 2007. Back in 2007, there was an oversupply of homes, whereas today there is a shortage. With more buyers than sellers bidding up prices, the U.S. median home price value hit a new record high of $338,000 at the end of 2017.

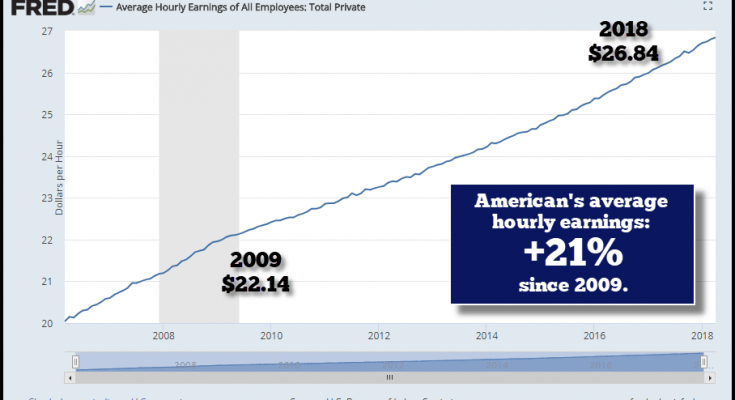

Unfortunately, wages have not kept up with rising home values. For example, the average hourly earnings have only increased 21% since 2009. However, the U.S. median home price $330,000 in Q1 2018 is 53% higher:

Now, to make up for the shortage of homes in the high-demand cities across the countries, the new-home building boom is once again on the rise. The U.S. housing starts in March are up to 1.3 million from the low of 478,000 at the bottom of the 2009 recession. Now, even though current housing starts are more than double what they were at the lows in 2009, they are nearly 50% less than the peak of 2.3 million in 2006.

However, there is a much different dynamic today as the cost to build a new home is much higher than it was in 2006. At the peak in 2006, the U.S. median new home price was $262,000 versus the $337,000 in Q1 2018. Moreover, the U.S. median new home price is 60% higher than the low in 2009:

Even though the average wages of an American increased 21% since 2009, the median new home price is 60% higher. Part of the reason for the higher new home price is demand but also is the higher cost. For example, the lumber price shut up 170% since the beginning of 2016. When the U.S. median new home price reached a high of $262,000 in 2006, the price of lumber was $330. Today, the lumber price isn’t quite double, but at $592, it’s pretty darn close:

You will also notice that the lumber price fell in mid-2014 to a low of $220 at the beginning of 2016. The falling lumber price was party due to the falling oil price. One of the significant costs for cutting and transporting lumber is energy. As the oil price fell in half by 2016, it impacted the price of lumber. However, the lumber price has increased a great deal more in percentage terms than the oil price and seems to be in a bubble or huge top formation.