After a stormy winter for the broad market and clean energy stocks, including my picks, March and April brought relative calm. Better yet, my model portfolio has rebounded from its February lows, although its benchmarks (SDY for the broad market of income stocks and YLCO for clean energy income stocks) have mostly been treading water.

The gains were led by two of my less conventional clean energy picks, Seaspan (SSW) and InfraREIT (HIFR). Seaspan owns (mostly very efficient) container-ships, which most people would not associate with clean energy, but which I include because they are much less energy intensive compared to moving a similar amount goods by any other means. InfraREIT is an owner electric transmission lines which, although not limited to carrying clean energy, are essential to the addition and integration of large amounts of wind and solar onto the grid. Along with wood pellet MLP Enviva Partners (EVA), three of my five least conventional clean energy picks are up for the first four months of the year. All of the five more traditional Yieldcos mostly invest in wind and solar are showing losses. For me, the lesson here is the value of diversification and looking at stocks others might not be considering. The importance of such diversification only increases when investing in an otherwise very narrow sector such as clean energy.

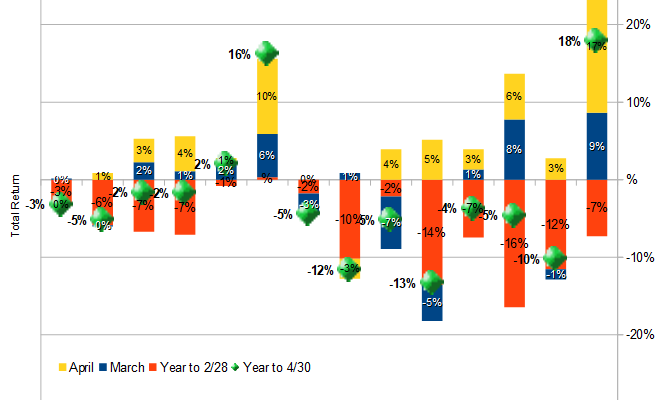

Overall, my broad market benchmark SDY fell 0.3% for the two months, and my clean energy benchmark YLCO rose 0.8%. The model portfolio of ten clean energy stocks jumped 4.3%. The real-money Green Global Equity Income Portfolio (GGEIP), which I manage, rebounded 3.9%. For the year to April 30, the model portfolio is down 1.8% and GGEIP is down 1.7%, while SDY is down 3.2% and YLCO is down 5.2%. All results are total return (i.e. they include dividends.)

My short term stock picking was less successful over the last two months. In the March update, I highlighted Covanta (CVA, up 1.2% in March and April), NRG Yield (NYLD-A, up 14.5%), Pattern (PEGI, down 0.3%) and Brookfield Renewable (BEP, down 1.5%) as attractive short-term buys. On average, these four picks were up only 3.5%, or less than the average return on all 10 picks.

Ten Clean Energy Stocks for 2018 model portfolio and benchmark total return, through April.

Stock discussion

Below I describe each of the stocks and groups of stocks in more detail. I include with each stock “Low†and “High†Targets, which give the range of stock prices within which I expect each stock to end 2018.

Seaspan Corporation (NYSE:SSW)Â

12/31/17 Price: $6.75. Annual Dividend: $0.50 (7.4%). Expected 2018 dividend: $0.50 (7.4%). Low Target: $5. High Target: $20.

4/30/18 Price: $7.69 YTD dividend: $0.25Â (3.70%) YTD Total Return: 17.8%Â Â

Leading independent charter owner of container ships Seaspan’s stock advanced steadily after hitting a low of $5.50 on March 13th as investors started to recognize the strengthening fundamentals of the shipping industry (something that Seaspan management has been commenting on for almost a year now.) Deutsche Bank raised its target price for SSW from $7 to $13 and bumped its rating to “Buy†based on a strong forecast for free cash flow.

On May 2nd, Seaspan reported first-quarter results. The strengthening fundamentals were clear in much stronger vessel utilization, which rose from 92% in the first quarter of 2017 to 97% this year, with a slightly larger fleet, leading to higher revenue and improved margins, causing the stock to continue its climb.

Covanta Holding Corp. (NYSE:CVA)

12/31/17 Price: $16.90. Annual Dividend: $1.00(5.9%). Expected 2018 dividend: $1.00 (5.9%). Low Target: $15. High Target: $25. Â

4/30/18 Price: $14.90 YTD dividend: $0.25 (1.480%) YTD Total Return: -10.3%Â Â

The stock of US leader in the construction and operation of waste-to-energy plants Covanta mostly treaded water for March and April. The company reported first-quarter results on April 26th. Overall, I felt the results were encouraging, with the company’s Fairfax facility operating well after a long outage for repairs and upgrades in 2017, and progress continues on new investments. After an initial positive reaction on the 27th, the stock puzzled me with a sharp sell-off. As I write on May 4th, it seems to have mostly recovered.

Although I remain puzzled by the sharp sell-off and rebound after the most recent earnings, I expect the stock to do well for the rest of the year if the company can just continue to operate its existing plants smoothly while slowly advancing its investment plans, most notably its UK partnership with Green Investment Group.

NRG Yield (NYSE: NYLD and NYLD-A)

12/31/17 Price: $18.90 / $18.85. Annual Dividend: $1.133(6.0%). Expected 2018 dividend: $1.26(6.7%) Low Target: $14. High Target: $25. Â

4/30/18 $17.80/$17.61 Price:Â YTD dividend:Â $0.607 (3.2%)Â YTD Total Return: -4.6%Â Â

The purchase of NRG Energy’s (NRG), sponsorship stake in NRG Yield by private infrastructure fund Global Infrastructure Partners (GIP) remains on track and is expected to close in the second half of 2018. The upcoming change in sponsors has not put growth on hold at NRG Yield: The Yieldco closed the acquisition of a solar farm from NRG Energy. The smooth transition is likely in part due to the fact that GIP is also buying NRG’s renewable development arm.