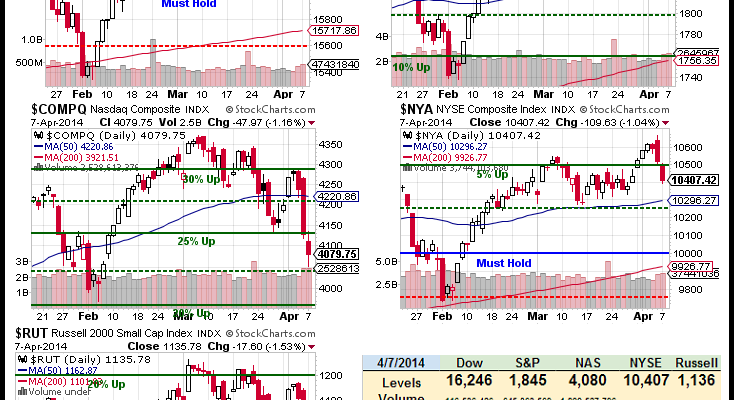

Wheeeeee – down we go!

We couldn’t be happier, of course – as we were feeling a little silly having cashed out a month ago, with the market making new highs on us.  Still, we stuck to our Fundamental guns and now we are outperforming the market by a mile this year and, even better, we have some exciting opportunities to use our sideline cash to do a little shopping – but not yet.

There’s no hurry.  Those XRT May $84 puts I mentioned in yesterday’s post that went from 0.85 last Thursday to $1.42 yesterday morning hit $2.35 into yesterday’s close.  That’s up another 65% in a day and that’s money that’s compounding for us on the way down, up 176% in 3 days now.  This is what we do with our sideline cash – so it’s not like we sit around twiddling our thumbs…

I sent out an Alert to our Members yesterday to sell the T July $35 calls for $1.10 to cover a long position we have on T.  Pre-market they are down 1% and those short calls are up 10% on day one already – but there’s 100 more days to go.  Again, this is what we can do with our sideline cash.  We also shorted JPM in an earnings spread – that trade is here from our Live Daily Chat Room. Â

We had lots of fun in our Futures trading, flip-flopping our bets for the bounces and catching nice moves in both directions – but mostly down.  We even made some quick money with long plays on the Momo stocks – also playing for bounces.  Our last trade idea of the day was shorting /NKD as it failed the 14,800 mark into the close (coupled with a falling Dollar and rising Yen) and that index fell straight down to 14,450, good for $1,750 per contract.  We were already longer-term short position on the Nikkei through our EWJ puts in the Short-Term Portfolio, this was just a bonus bet.  We also added JNJ May $95 puts at .80, those could be fun if the weakness continues. Â