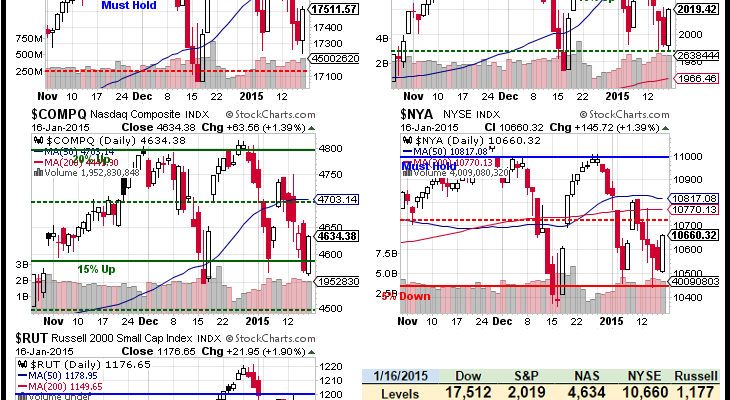

2,027 is our goal today for the S&P.

After that, we’ll turn our attention to 2,040 tomorrow (the 10% line on our Big Chart) and we need 22 Nasdaq points to make that strong bounce line and then we’ll look for 4,700 to come back on MORE FREE MONEY from the ECB on Thusday. Â

Our Bounce Lines from last were were (and still are):

- Dow 17,280 (weak) and 17,460 (strong)

- S&P 2,006 (weak) and 2,027 (strong)

- Nasdaq 4,608 (weak) and 4,656 (strong)Â

- NYSE 10,560 (weak) and 10,670 (strong)Â

- Russell 1,172.50 (weak) and 1,185 (strong)

China made their own weak bounce overnight and that’s already enough to get our Futures back on track but, as you can see from the chart on the left – this morning’s bounce to 3,173 erases only 50 points out of a 275-point drop, which just happens to be the very definition of a weak bounce per our 5% Rule™. Â

So, to sum it up – we are likely to have strong bounces as traders are relieved to see China having weak bounces and, of course, in anticipation of MASSIVE stimulus coming from the ECB on Thursday – what could possibly go wrong?  Well, for one thing, Draghi can disappoint us on Thursday (again), China could turn lower after the weak bounce and we can hear about more trading companies in trouble over their Swiss Franc gambles.  How’s that for starters?

China’s GDP was less than exciting this morning at 7.4%, it was the slowest growth in 20 years and oil fall back to $47.50 (where we are long /CL) and Natural Gas fell back to $2.90 (where we are longh with tight stops on /NG) and gasoline is back to $1.34, but that one we stopped out of from our $1.30 long entry on /RB).  The IMF says China will slow to 6.8% this year and that’s a high estimate compared to UBS (6.5%) and Oxford Economics (6%) – as well as intelligent observation. Â