Well, it’s happening. It might be subtle. You might not be able to point to X causing Y, but make no mistake – the Federal Reserve is still run by humans, and those humans want to appease the boss. And that boss no longer wants to chastise banks for their transgressions from a decade ago. The man who ultimately chooses the FOMC board members wants the economy to go as fast as possible regardless of the risks.

We really shouldn’t be surprised with the headline from last week that the Federal Reserve is working on a proposal to ease up on bank leverage limits. From the article in Bloomberg:

The Federal Reserve is working to relax a key part of post-crisis demands for drastically increased capital levels at the biggest banks, according to people familiar with the work, a move that could free up billions of dollars for some Wall Street’s giants.

Central bank staffers are rewriting the leverage-ratio rule – a requirement that U.S. banks maintain a minimum level of capital against all their assets – to better align with a recent agreement among global regulators, said two people who requested anonymity because the process isn’t public. The people said the Fed effort is drawing opposition from the Federal Deposit Insurance Corp., an agency with authority over banking rules that’s still led by a Barack Obama appointee.

The fact the Obama appointee is pushing back on the changes highlights the difference in the two administrations’ tack on policy.

Leverage is going higher

Now you might think adding leverage this late in the cycle might not be a prudent move. On the other hand, you might believe the US has been hamstrung by anti-business policies for too long and it’s time to let her stretch her legs unencumbered. It doesn’t really matter what you, or I, believe is the correct course of policy. All that matters is what is happening. It is foolish to not adjust your investment stance based on this change.

Make no mistake – this change in Federal Reserve policy is potentially a really big deal. To understand why let’s recap how the economy got into the current situation.

How we got here

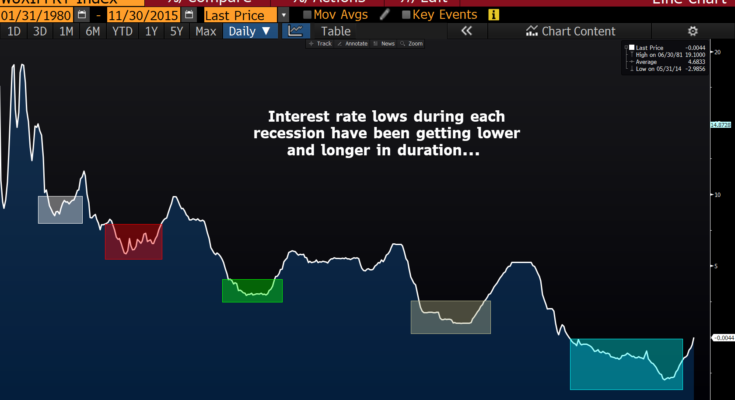

During modern economic history, credit growth has largely gone only one way – higher. As Western societies have layered more and more debt on the global economy, each recession has needed more and more monetary stimulus to counter-act the slowdown. This partly explains why each recessionary trough has seen progressively lower interest rates.

When the 2008 Great Financial Crisis hit, many market participants believed we had hit the Minksy moment. There had been so much debt piled onto the economy, there was simply no way it could continue to function without a cathartic cleansing.

Yet instead of allowing the system to reset in a painful debt destruction cycle, governments throughout the world engaged in a series of quantitative easing programs, the likes of which had never been seen.