(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 64.1%

T2107 Status: 69.8%

VIX Status: 12.9

General (Short-term) Trading Call: bearish

Active T2108 periods: Day #120 over 20%, Day #26 over 30%, Day #25 over 40%, Day #24 over 50%, Day #1 over 60% (ending 1 day under 60%) (overperiod), Day #3 under 70%

Commentary

Days like these make it tough to stick to trading rules!

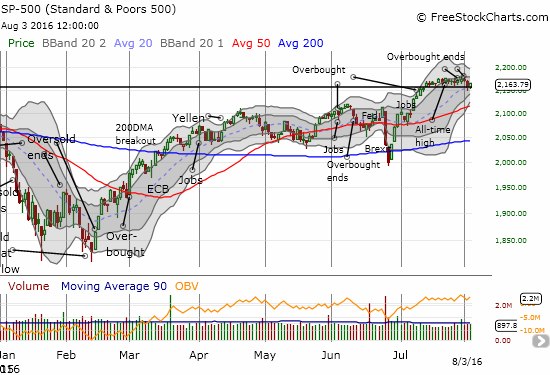

In the last T2108 Update, I determined that the S&P 500 (SPY) was “close enough†to a breakdown to change my short-term trading call from cautiously bearish to bearish. It turned out that the bears and sellers were not ready to follow-through. The S&P 500 bounced in near picture-perfect form from the bottom of the recent trading range. The index even closed on its high of the day.

The S&P 500 is not quite ready to confirm a near bearish tone in trading.

Along with the bounce, T2108 stepped over 60% again and closed at 64.1%. This puts my favorite technical indicator back in sniffing distance of the overbought threshold.

Dip buyers were in effect everywhere.

As I speculated could happen, oil bulls took the “bear market†in oil as a buying trigger. United States Oil (USO) hopped 3.9% but stayed within the downward trading channel.

United States Oil prints an impressive relief bounce.

If oil sustains buying interest, I will likely need to stop out of my recent bear trades on oil. I would resume the trade on a fresh low for oil – I am not confident that attempting to find a top to fade will work any better than playing a breakdown. If I were a bull, I would just buy here and stop out on a new low. It is a great risk/reward trade that makes it tough to stick to my current trading rule (granted – there is no reason to assume that being bearish on stocks requires a bearishness on oil).