(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 59.4%

T2107 Status: 66.7%

VIX Status: 11.5

General (Short-term) Trading Call: bearish

Active T2108 periods: Day #231 over 20%, Day #51 over 30%, Day #50 over 40%, Day #48 over 50% (overperiod), Day #2 under 60% (underperiod), Day #11 under 70%

Commentary

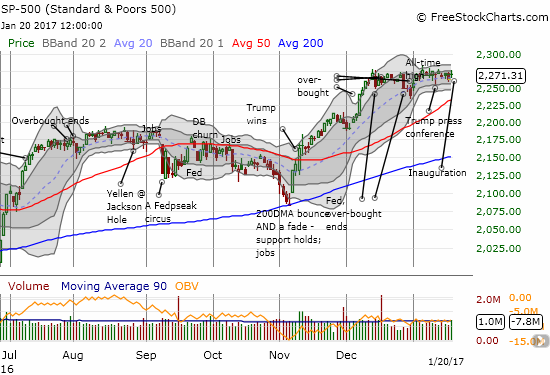

I had hoped that the inauguration of Donald J. Trump as the 45th President of the United States would provide a catalyst to nudge the market into the direction of its next big move. No such luck. It was another blah day on the market as the S&P 500 (SPY) gained 0.3% with the high of the day neatly stopping near the top of the current trading range.

What big event? The S&P 500 barely responds to the Trump inauguration.

T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), bounced back from the drubbing it took on Inauguration Eve. The close at 59.4% still keeps my favorite technical indicator locked into its current downtrend and maintains the on-going bearish divergence with the market.

Interestingly, the volatility index, the VIX, DID make a big move. The VIX plunged 9.7% to drop toward its recent lows. It never even occurred to me that the last rise in volatility was related to lingering anxieties over the inauguration. Otherwise, I would have proposed fading volatility as part of a very short-term trade, similar to the post-Fed fade of volatility.

The volatility index, the VIX, takes a post-inauguration plunge.