(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 40.2% (fell from 66.99%)

T2107 Status: 57.3% (fell from 67.4% – and from post-recession downtrend line)

VIX Status: 25.8 (jumped 49%!!!)

General (Short-term) Trading Call: bearish

Active T2108 periods: Day #93 over 20%, Day #92 over 30%, Day #89 over 40%, Day #1 under 50% (ending 3 days over 50%), Day #1 under 60% (ending 1 days over 60%), Day #11 under 70%

$FXY puts look “cheap”. Bought July as hedge to bear pos & central bank intervention. $FXB puts looked cheap yesterday! $USDJPY #120trade

— Dr. Duru (@DrDuru) June 24, 2016

That tweet best describes my response to the carnage that was June 24, 2016, post-Brexit Day #1. After closing out a lot my bearish trades, I realized that I had to start thinking about a potential bounce. With USD/JPY trading around the 100 level, a fade on the Japanese yen (FXY) seemed like one of the more “obvious†trades. Going long the British pound (FXB), eventually, also looks like a great risk/reward trade for the longer-term (see “A Failed Hedge Underlines Potential For A Bottom In The British Pound“).

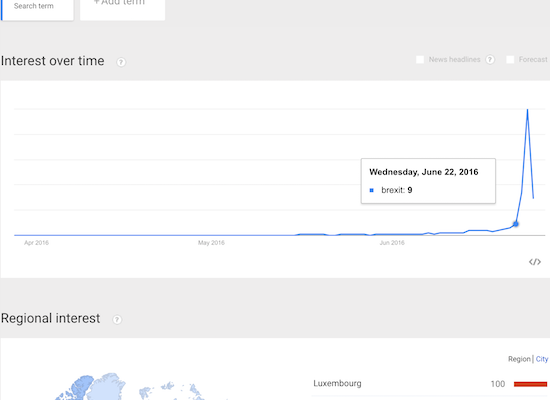

Sentiment on “Brexit†has to-date performed well as a trading tool. The steady increase in the search index, outside of one day with a downward blip, kept me focused on the bearish implications of the apparent anxiety. That anxiety reached a feverish pace by Friday with Luxembourg, of all things, suddenly topping the regional list of searchers. Note that Wednesday used to be the 100 (maximum) index level for what THEN looked like a rapid acceleration of searches. Now, the index for Wednesday is only a 9. Friday hit 100. Saturday fell back to 29. (The U.S. is nowhere to be found in the top 10 regions or cities – I will be looking to see whether this absence starts to change if/when Brexit has a larger impact on financial conditions in the U.S.)

Luxembourg suddenly shows up in Google searches on Brexit as sentiment cools off from extremely high levels.

Source:Â Google Trends

I will next look to see whether Brexit returns to its previous insignificance as a search term or whether some new and higher baseline develops. A recognizable baseline will provide a platform for planning new trades. In the meantime, there is still ol’ reliableT2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs).

In case you were confused about the UK’s relationship with Europe…

Video length: 00:01:45