(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are sometimes posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 67.4%

T2107 Status: 49.3%

VIX Status: 16.9

General (Short-term) Trading Call: Neutral – waiting for resolution of this move toward overbought status

Active T2108 periods: Day #75 over 20%, Day #34 above 30%, Day #14 over 40%, Day #3 over 60% (overperiod), Day #145 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDSÂ (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEMÂ (iShares MSCI Emerging Markets)

VIXÂ (volatility index)

VXXÂ (iPath S&P 500 VIX Short-Term Futures ETN)

EWGÂ (iShares MSCI Germany Index Fund)

CATÂ (Caterpillar).

Commentary

I could easily talk breathlessly about how T2108 continues to surge toward overbought conditions. However, with a U.S. jobs report coming early Friday morning that could easily change the technical outlook, I will focus in on a few key observations and trading updates. I will do my best to avoid any predictions.

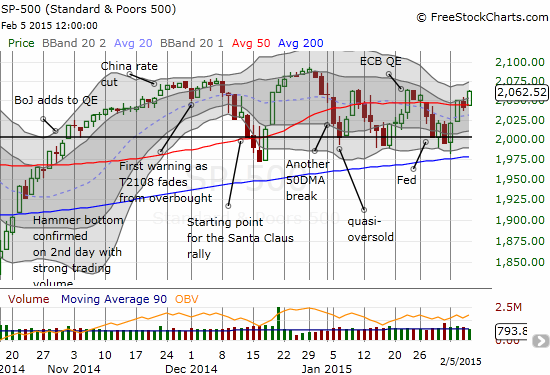

T2108 closed at 67.3%, its highest close since late November’s close encounter with overbought conditions. This is the third out of the last four trading days where T2108 has exhibited large gains. I consider today’s surge to be a confirming follow-through to Tuesday’s breakout. The S&P 500 (SPY) delivered on this follow-through with a 1% gain that pushes the index off its 50-day moving average but right at the top of the churn in place since the beginning of the year.

Â

The S&P 500 pops to the top of the most recent trading range, putting fresh all-time highs within tantalizing reach again

The VIX dropped another 8% but also remains well within its recent chopping range. So the market is now very primed to maintain its ranges with a pullback in the S&P 500 and a resurgence in volatility. I will consider a break of these ranges to be a VERY bullish event even with T2108 crossing into overbought territory (extended overbought rally anyone?).