Greek Election – Decisive Victory by SYRIZA

With more than 95% of the votes in Greece’s parliamentary election counted as of the time of writing, Greece’s far-left Syriza led by Alexis Tsipras was already certain to have won a decisive victory.

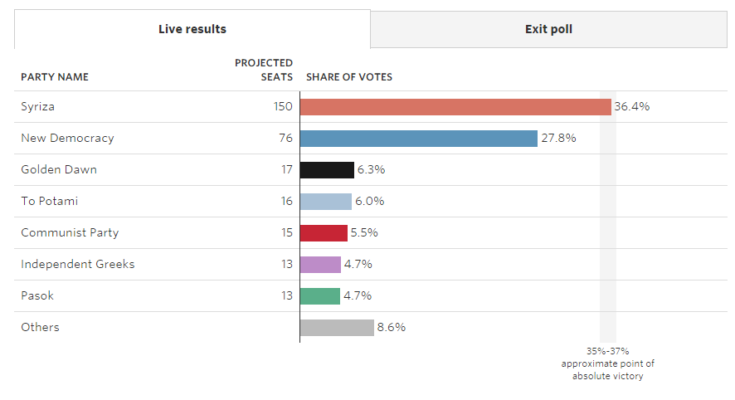

Greek election results after more than 95% of the votes had been counted – click to enlarge.

Although this is not certain yet as we type this, the chart above suggests that Syriza may well have attained an absolute majority in terms of parliamentary seats (the winning party automatically gets an additional 50 seats in Greece’s 300 seat parliament).

Whether or not Syriza has an absolute majority in parliament, it will definitely form the next government, as it has already clinched a coalition deal with the small Independent Greeks party (ironically, a centre-right party that has broken away from Antonis Samaras’ New Democracy party, but is united with Syriza in its opposition to the bailout and austerity package). However, should Syriza turn out to be able to govern without a junior partner, there is a good chance that the more radical elements in the party (which itself is a hodge-podge coalition of various leftist parties) will gain greater influence over the new government’s policies.

This is not unimportant, as we have pointed out previously (see: “Grexitology, a Mexican Standoff†for details). While Syriza’s leadership has reportedly backed away from the threat of just “tearing up the bailout agreementâ€, this is definitely not a stance supported by everyone in the party. Syriza is the most left-wing party to attain political power in Europe since WW2 and the leader of its left-most wing, Panagiotis Lafazanis, is on record for stating the following:

“We want to exit the euro and a complete break with the totalitarian EU.â€

If Syriza is forced to form a coalition, more moderate views are likely to prevail, not least because the Greek government doesn’t exactly have a great many choices given its fiscal condition, regardless of who runs it. Keep in mind that said condition is closely intertwined with that of the country’s banking system, which serves as one of the main conduits for funding the government whenever bailout tranches are late due to disagreements with the “troikaâ€. Ahead of the election, the four largest Greek banks were already faced with a “mini-run†on deposits and all of them applied preemptively for ELA (emergency liquidity assistance). It is up to the ECB council whether such assistance is granted or not.

The left-wingers in the party may well overestimate the fiscal leeway the government would enjoy in the event of an outright default. Given that the government currently runs a primary surplus, it theoretically won’t require outside financing if it ceases to service its debt. However, since Syriza inter alia plans to rescind the property tax introduced by the previous government and intends to vastly increase government spending, the primary surplus could prove ephemeral. Needless to say, if the party’s militant left wing were to get its way, what little investment activity there is would dry up as well and capital flight would accelerate. As of the end of 2013, government spending had already reached a record 59% of GDP (we were unable to find more up to date figures):