Being able to print your own money and buy stocks at any price sure can be fun. Just as the SNB which unlike many other (if ever fewer) central banks admits to doing just that.

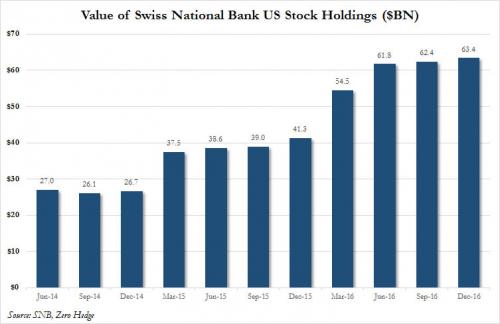

In its latest 13F filing, the Swiss National Bank reported that the value of its portfolio of US stocks rose again in the fourth quarter, increasing by 1.6% from $62.4 billion as of Sept. 30 to a record high $63.4 billion at the end of the year.

Over the past two years, the total Assets under management of this massive hedge fund, which occasionally engages in massive currency manipulation with disastrous results, have increased from $26.7 billion to $63.4 billion, a 138% increase, mostly as a result of relentless currency manipulation and monetization of various assets, including both bonds and stocks.Â

(Click on image to enlarge)

In its latest 13F, the SNB reported stakes in 2,564 companies, up from 2,536 in the previous quarter.

SNB policy makers, among them Governing Board Member Andrea Maechler, have said many times that they invest for the benefit of monetary policy, replicating broad-based indexes, and not to generate a profit, although with the S&P500 at all time highs, they have also achieved that. The SNB excludes some companies on ethical grounds, according to Bloomberg.

The SNB’s biggest holdings as of December 31 were the following:

(Click on image to enlarge)

But the biggest surprise in the latest filing – aside from a central bank admitting to buying stocks of course – is that for the second consecutive quarter, the amount of AAPL shares, the SNB’s top position, has actually declined, dropping to 15 million as of Dec. 31, from a peak of 15.6 million as of June 30. The value, however remained roughly unchanged making some wonder if the SNB may have hit its limit when it comes to US equity allocation, if only for the time being.

(Click on image to enlarge)