<< Read More:Swan Song Of The Central Bankers, Part 3: The Goldilocks Economy Delusion

<< Read More:Swan Song Of The Central Bankers, Part 2: Yellen’s “My Girl”

<< Read More:Swan Song Of The Central Bankers, Part 1: Last Week Wasn’t An Error

The dirty secret of Keynesian central banking is that under current circumstances its interventions have almost no impact on its famous dual mandate—-stable prices and full employment on main street.

That’s because goods and services inflation is a melded consequence of global central banking. The capital, trade, financial and exchange rate movements which result from the tug-and-haul of worldwide central banking policies generate incessant shape-shifting impacts on the CPI; and the ebb and flow of these forces completely dwarfs FOMC actions in the New York money and bond markets.

In today’s world, there is no such thing as inflation in one country. In that regard, the traditional Fed tool of pegging the funds rate is especially obsolete, impotent and ritualistically mindless. After all, if the 2.00% inflation target is meant as a long haul objective, it was achieved long ago. The CPI index for January 2018 at 249.2 compared to a level of 169.3 back in January 2000, thereby representing exactly a 2.17% compound annual gain over the 18 year period.

So where’s the Eccles Building beef about missing its target from below—even if that wasn’t one of the more ludicrous notions of “failure” ever to arise from the central banking fraternity?

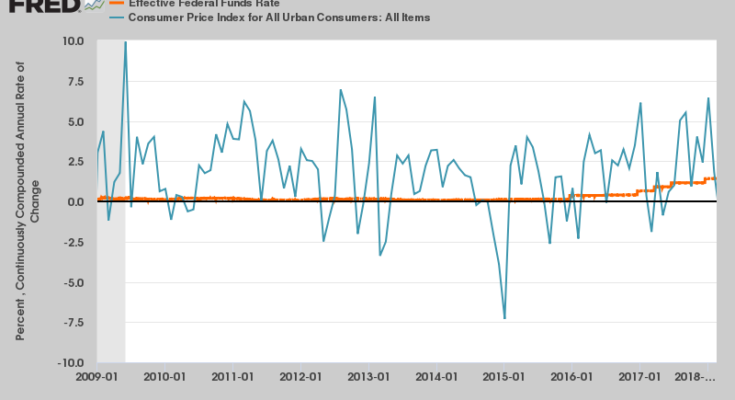

On the other hand, if 2.00% is meant as a short-run target, how much more evidence do we need? Since the Fed shifted to deep pegging at or near the zero bound in December 2008, there has been no inflation rate correlation with the funds rate whatsoever.

(Click on image to enlarge)

In the sections below we will resolve the inflation matter once and for all by demonstrating that the very idea of 2.00% inflation targeting (or any other target) is singularly stupid and destructive. What the free market/sound money doctor actually calls for is just the opposite: That is, consistent, secular deflation so that domestic prices, wages and costs—which are perched near the top of global cost curves—-can be brought into better competitive alignment.

By the same token, the full employment objective is equally vestigial. That’s because the channels of monetary policy transmission to the real main street economy are broken and done.

With households at Peak Debt, cheap interest rates do not stimulate incremental borrowing and consumption spending: Households have been left with only their paychecks to spend, and what remaining raining day funds (savings) they have not already tapped.

The current levels and risk spreads on unsecured personal loans, in fact, show exactly why the credit channel to households is frozen solid.

With more than $15 trillion of total household debt and other liabilities, it is now all about credit risk. Even in the case of the very highest credit scores, unsecured personal loan interest rates are essentially prohibitive and are designed to recover huge, predictable losses for dodgy credits, not stimulate a tsunami of new consumer borrowing and spending.

The (unsecured) personal loan rates quoted below are more or less in line with the current average APR on credit cards, which stands at 16.15%.

Excellent Scores (720-850)……………………10.5%-12.5%

Good Scores (680-719)………………………….13.5%-15.5%

Average Scores (640-679)…………………….. 17.8%-19.9%

Poor Scores (300-639)…………………………..28.5%-32.0%

The only real categories of household credit still growing are student loans, which are essentially government guaranteed entitlements, not commercial credits; and auto loans, which are collateralized by vehicular rolling stock. The latter, in turn, are kept liquid on a low cost basis by the repo man equipped with sophisticated vehicle tracking and disabling technology.