(Click on image to enlarge)

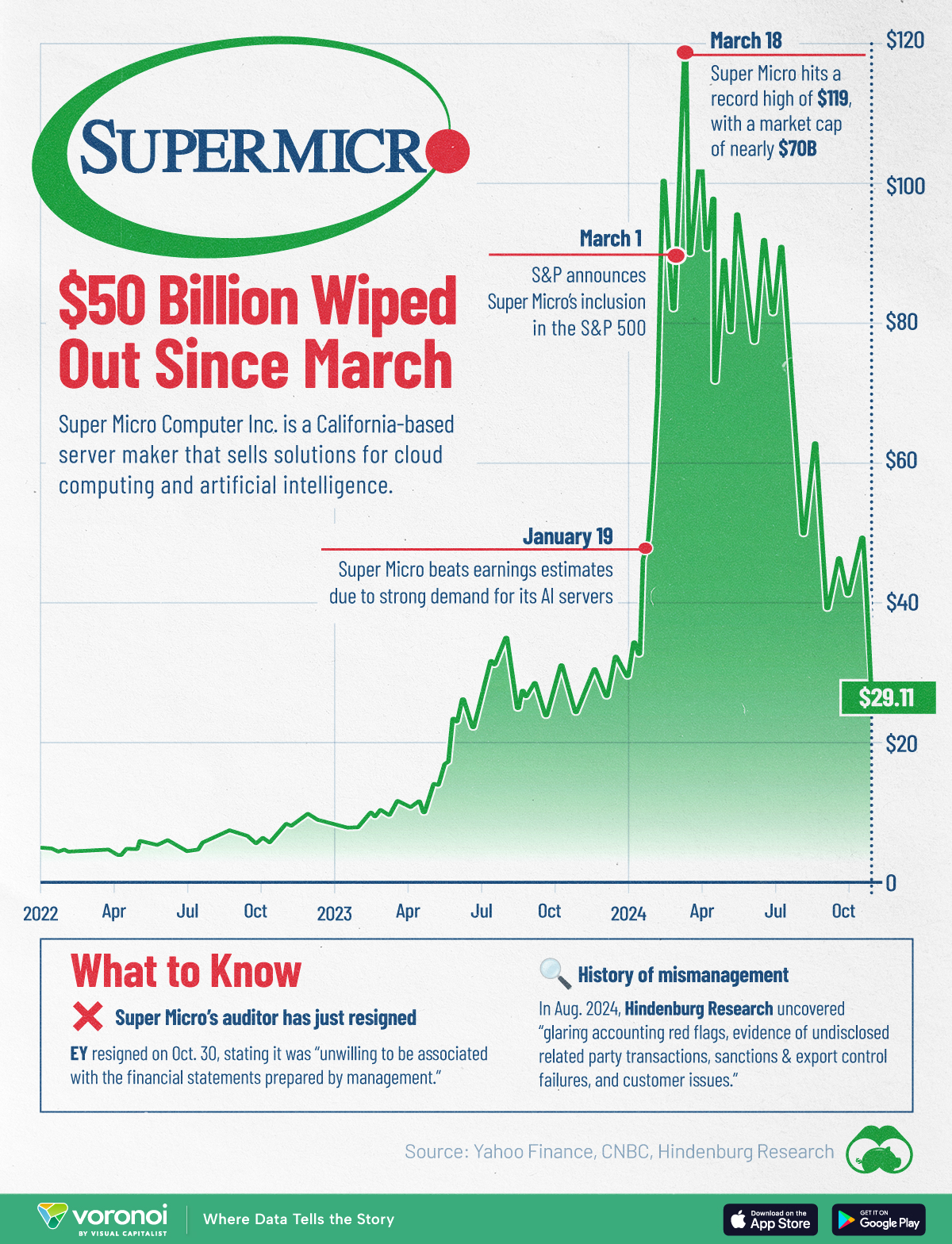

Super Micro Computer Inc.(), once a leading AI tech stock and one of the most recent additions to the S&P 500, has seen a spectacular rise and fall in 2024.Roughly $50 billion in market cap has been wiped out since the company hit an all-time high in March, with the latest blow being the resignation of its auditor.In this graphic, we cover everything you need to know about Super Micro’s ongoing drama.

What Does Super Micro Do?

Super Micro is a California-based manufacturer of server and storage solutions for data centers, cloud computing, and artificial intelligence (AI). Amid the AI-hype rally, the company’s shares rallied 2,000% over two years thanks to its close relationship with .Major customers of Super Micro include CoreWeave, an American cloud-computing startup, and Tesla.

What Went Wrong?

In August 2024, short seller published a report on Super Micro uncovering “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”While the claims in this report have not been independently verified, one particularly alarming discovery is that exports of Super Micro’s components to Russia have tripled since the invasion of Ukraine, violating U.S. export bans.Around the same time this report was released, Super Micro announced it would not file its annual report for the fiscal year on time, causing its stock to drop 20%.The following table shows monthly price data and YTD return for Super Micro in 2024. Note that these prices take into account the company’s recent 10:1 stock split.

Ernst & Young resigns as Super Micro’s auditorThe latest story regarding Super Micro is that its auditor, Ernst & Young, has resigned, stating it was “unwilling to be associated with the financial statements prepared by management”.Interestingly, EY had only just replaced Deloitte as Super Micro’s auditor in March 2023, shedding further light on Super Micro’s internal issues.Looking further back, Super Micro was temporarily delisted from the Nasdaq in 2018 for failing to file its financial statements on time. In 2020, the company was also charged by the SEC for “widespread accounting violations” that included understating expenses.

What’s Next?

Super Micro must find itself a new auditor to stay compliant with Nasdaq, or it could be delisted. Finding a new auditor could be difficult, given the company’s history of accounting manipulation.More By This Author:

Super Micro, Once The Hottest AI Stock Of 2024, Has Collapsed