Post-Thanksgiving, I slightly tempered my bullish exuberance over the very short-term, meaning the next few weeks. It wasn’t enough to take any meaningful action as the downside looked limited and I do not have high conviction. But the market looks a bit tired and full from its big November meal.And for those who pay attention to the trades I post at the end of each blog, we have done very little across our 18 strategies over the past few weeks.On Twitter, I posted that gold stocks were quietly breaking out on Tuesday. The $30 level on GDX had acted like a ceiling for the past few months. GDX should move higher above $32 before year-end although I expect one of our strategies to want to sell before then unless it continues surging this week.(Click on image to enlarge)

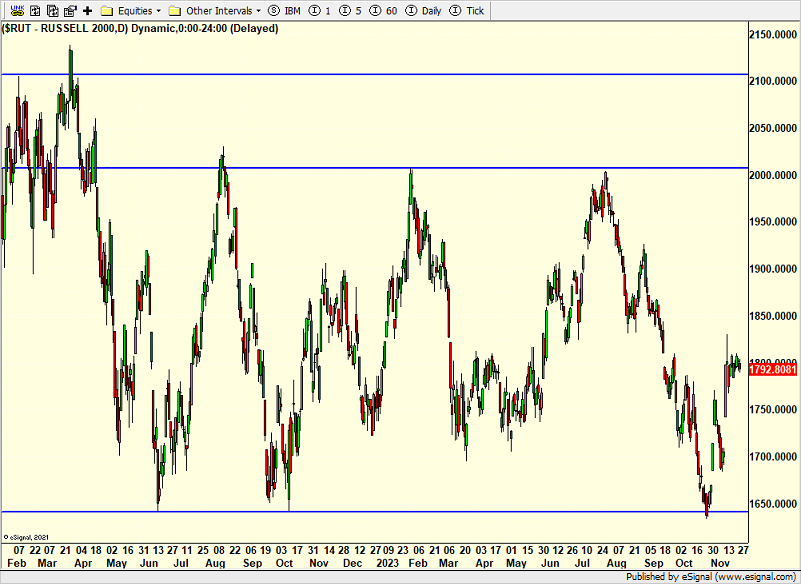

One of the asinine arguments the bears keep making is that because the Russell 2000 index of small cap companies has lagged so pathetically, it remains a bear market. That index is below with my horizontal, blue lines drawn in. The Russell is still down 10% from its August peak as the bears state. However, it is also up 9% from its October bottom.I agree 100% that small companies have lagged as the cost of capital has hit them particularly hard. But the rest is nonsense. The Russell needs to get above the 2000 area sooner than later and stay there. And by the way, I think there are and have been good short-term opportunities in small caps. Rent them. Don’t own them.(Click on image to enlarge) On Monday we bought levered S&P 500 and levered inverse Russell 2000.More By This Author:

On Monday we bought levered S&P 500 and levered inverse Russell 2000.More By This Author:

Stocks Look Full As Gold Breaks Out & Bears Scream About Small Caps