Yeah, this happened…

And so did this…

Â

So this…

April was a volatile month in markets - bonds, bullion, and stocks higher; crude, copper, and base commodities all tumbled

- US Equities up for 5th of last 6 months (highest monthly close ever)

- S&P Tech Sector up 5 months in a row – longest streak since Aug 2014Â (record monthly close)

- S&P Energy Sector down 4th month in a row (lowest monthly close since July)

- Treasury Yields fell for the 3rd of the last 4 months (lowest monthly close in yields since October)

- WTI fell for 2nd month in a row (lowest monthly close since August)

- Copper down for 3rd month in a row – longest losing streak since Oct 2015 (lowest monthly close since December)

- Dollar Index fell for 3rd of last 4 months (lowest monthly close sine October)

- GBP/USD has risen for 6 of the last 7 weeks (and April was GBP’s best month since April 2015)

- Gold was up for the 4th month in a row – longest winning streak since Aug 2012Â (highest monthly close since October)

Bonds, Bullion, and Stocks all rose around 1.25% on the month, but Banks were down in April (and March) for the worst 2-month drop since Feb 2016.

Â

Tech led the month, Energy lagged…

Â

Dollar Index fell for the 2nd month in a row (3rd of 4) erasing most of the gains post-Trump

Â

*Â *Â *

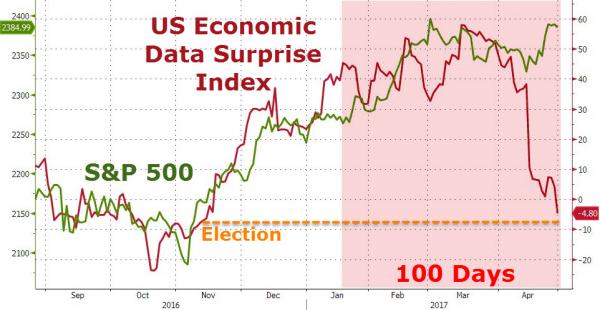

It was a tough week for ‘soft’ data and reality-checks – who do you trust to forecast reality?

Â

But stocks were all higher (apart from Trannies)…The best week of the year for The Dow!!! But it ended on a weak note…

Â

Small Caps were hit hard today as “Most Shorted” stocks’ squeeze seemed to end…

Â

Utes were the only sector red on the week, Healthcare and Tech led (with Financials solid post-Macron)…

Â

Breadth has remained weak in this entire recent surge…