European stocks slipped from an 11 month high, Asian stocks and S&P futures were flat as caution pervades global markets before the Federal Reserve’s expected interest-rate hike on Wednesday. Crude dropped to session lows near $52 after API data showed U.S. stockpiles increased, and after a Manaar Group consultant said Iraq won’t cut output by 180k b/d-220k b/d as it committed to do under Nov. 30 OPEC agreement.Â

Top corporate news stories include Johnson & Johnson ending Actelion pursuit, IBM vowing to add 25,000 jobs, Hertz replacing its CEO, the WSJ reporting that Goldman is planning to appoint Harvey Schwartz and David Solomon to succeed President Gary Cohn.

“Markets are very much on hold ahead of the Fed,†said Marc Ostwald, strategist at ADM Investor Services International in London told Bloomberg. “The Treasury rally is also helping to pull yields elsewhere lower, along with a slip in oil prices and a softer tone to equities. Changes to the Fed dot plot and economic forecasts will be key to watch.â€

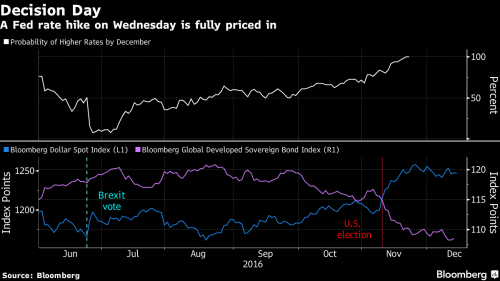

Today’s FOMC decision has been overshadowed by some big events over recent weeks. As DB’s Jim Reid writes in his overnight piece, today’s outcome has barely registered on people’s radar as a potential macro event. Consensus is the expected 25bp hike but with a wait and see approach from Yellen where she’ll reiterate that it’s too early to second guess potential upcoming fiscal changes. A December rate hike is now fully priced in by the market.

However DB’s Peter Hooper does think that the overall message will be modestly hawkish given the shift in risks toward higher growth and inflation ahead. The more hawkish signs should come from a mention of the decline in unemployment and further increase in market based measures of inflation compensation while near term risks should now be noted as fully balanced rather than roughly balanced. The interesting and more uncertain element will be how they treat forward guidance. DB thinks that it’s quite possible that they add ‘changes in fiscal policy’ to the list of factors that will determine ‘the timing and size of future adjustments to the funds rate’. More important is whether they decide to change expectations of ‘gradual’ increases in the fed funds rate and rates remaining ‘for some time’ below levels expected to prevail in the long run.

The economic projections and the dots are clearly the other big focus. Consensus expects only modest upward revisions to growth and possibly inflation forecasts, and unemployment to be revised down. In terms of the dots, Peter highlights that while it will take only two dots moving up to raise the median from two to three rate increases next year, he does not expect the Committee leadership to change their view significantly just yet. He notes that they will need to see more about how events unfold with the new Administration and the new Congress before making appreciable changes.

The Fed’s path to tighter monetary policy has been delayed throughout 2016, as first instability in Chinese markets, then the shock votes for Brexit and Donald Trump, put policy makers on the defensive. The U.S. central bank is expected to boost borrowing costs just as the focus shifts back to governments, with fiscal easing at the hands of incoming U.S. President Trump speculated to drive economic growth. After Wednesday, traders see a two-in-three chance of additional rate increases from the Fed by June, futures show.

“Last year the Fed guided the markets to expect at least four rate rises this year, guidance that proved to be woefully wide off the mark, and it is likely that they won’t want to make the same mistake again,†Michael Hewson, chief market analyst at CMC, wrote in note. That “suggests that Fed chief Janet Yellen can expect some serious cross examination of how the FOMC view not only the economy, but also President-elect Donald Trump’s plans for it.â€

An additional consideration this year is how Trump may respond to the Fed announcement, and whether he will tweet his reaction in response to the Fed announcement. As Bloomberg put it, “if you’re looking for drama surrounding this week’s meeting of Federal Reserve officials, don’t look for it in their post-meeting statement. Policy makers are almost universally expected to raise their benchmark lending rate. Keep an eye, instead, on President-elect Donald Trump’s Twitter feed.”

He was a harsh critic of Fed Chair Janet Yellen during the election campaign, and how the nation’s incoming chief executive reacts to the expected hike on Wednesday may reveal much about whether and to what extent Trump will try to pressure the central bank through the remainder of her current term, which expires in February 2018.

Investors have already pushed up bond yields since Trump’s surprise Nov. 8 election win in anticipation of higher inflation. They are likely to take note of any White House bullying of the Fed, which is expected to continue raising rates next year, albeit at a very gradual pace.

“It’s an important thing to keep an eye on,†said Donald Kohn, a former Fed vice chair who is now a senior fellow at the Brookings Institution in Washington. “It helps policy making, and the public perception of policy making, if the administration is not publicly commenting. It reinforces the idea of a monetary authority independent from short-term political pressure. Eroding that would be moving in the wrong direction.â€

So keep a close eye on what Trump tweets after 2:00 pm ET, a moot notice considering how much single-name volatility Trump’s tweets have generated in recent weeks.

The Stoxx Europe 600 Index retreated before the conclusion of the Fed’s two-day meeting, as investors awaited clues on the likely path of rates in 2017. Yields on 10-year U.S. Treasuries slipped, after reaching the highest level in more than two years on Monday, while European bonds also climbed. Oil in New York slid to near $52 a barrel before an official inventories report, and currencies of commodity-exporting nations fell. Gold headed for its biggest gain in a week.