The Stock Exchange highlights the results from different technical trading methods. We also provide contrast, and often dissent, from a fundamental analyst. While the methods sometimes agree, our emphasis is on trading.

Review

Our last Stock Exchange took up an important question – how to deal with a losing trade. Any trader who has not planned for this in advance is headed for trouble. If you missed last week’s edition, check it out.

This Week— Buy the Dip or the Rip?

This is not the famous favorite slogan, but it fits today’s choices.

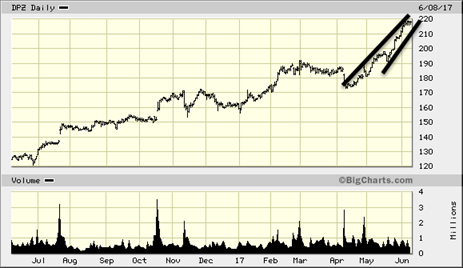

Road Runner: I have another great opportunity to buy a stock at the bottom of an up-trending channel. Domino’s Pizza (DPZ) shows great overall strength with an occasional buying opportunity. Now is the time.

RR: I suppose you will once again invoke Chuck Carnevale and F.A.S.T. graphs.

J: Naturally. Unlike last week, you are once again way out over the cliff.

RR: I am sorry that Mr. Carnevale does not appreciate my chart reading.

J: You do have some support. The research team at Société Financiers likes the explosive growth in revenue. Société Financiers concludes that the stock is 22% undervalued. Julian Robertson’s Tiger Fund has increased its position.

RR: You see? I am not the only expert! Beep Beep!

Oscar:Â I have a new sector choice: 3D Printing. While I have my own basket of stocks for this sector, we can look at ExOne (XONE) as an illustration for the group.

This chart combines the best of little ball and big ball.

J: I knew you would get around to baseball.

O: It is relevant. When the stock declines a bit, it is as if they are playing in a one-run game. Bunting and sacrificing are OK.

J: Hmm-maybe. I suppose you do not care about earnings. I am not even going to post the F.A.S.T. chart since you would see a string of negative values. This is just a story stock.

O: And it has a good story.