(Click on image to enlarge)

Today’s stock market is dominated by the Magnificent Seven: Apple , Microsoft , Google , Amazon , , Tesla , and Nvidia . Most of these companies have trillion dollar valuations, and have by a huge margin.And while these companies have solidified their roles in everyday life, powering AI, cloud computing, and more, their dominance echoes the tech boom of the early 2000s, raising questions of sustainability.To understand this issue more, we compare the Magnificent Seven (Mag 7) with seven of the top stocks from the 2000s Tech Bubble.

Data and Methodology

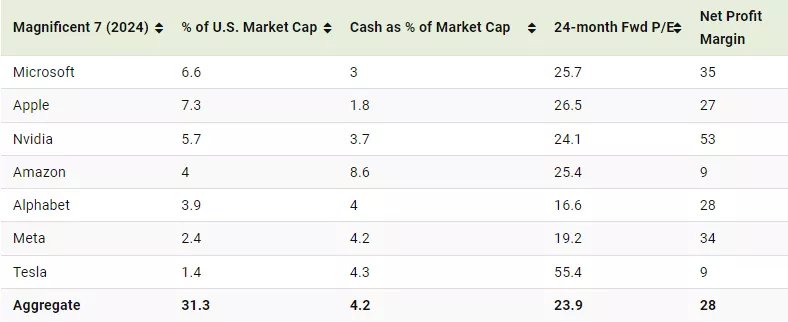

The figures we used to create this graphic can be found in the tables below. Data was accessed from (Sept. 5, 2024).Starting with the Mag 7 (data as of Sept 2024):

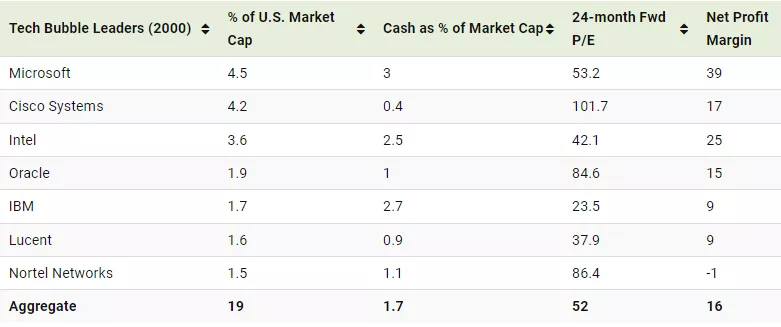

And next, the leading stocks from the 2000s tech bubble (data as of March 24, 2000)

From this comparison, we can see that the Mag 7 represents over 30% of the U.S. market, which is significantly more than the 19% held by the seven leading tech stocks in the 2000s.Such a high concentration among very few companies could be seen as a source of risk, though it appears that the Mag 7 stocks are relatively stronger.Compared to the 2000s group, they have higher profit margins, larger cash reserves, and are more attractively priced (as evidenced by their lower forward P/E ratios).A counterpoint to these metrics, however, is the Mag 7’s use of (with the exception of Tesla and Amazon). Stock buybacks inflate earnings per share (EPS) because they reduce the number of shares outstanding (company earnings are divided by a smaller number).Apple is the biggest offender in this regard, buying back $83 billion in shares between June 2023 and June 2024. This was equivalent to 2.8% of its market cap at the time.More By This Author:Ranked: The Fastest Shrinking Jobs In The U.S. (2023-2033F)U.S. Vs. China: Which Country Is The World’s #1 Superpower? Government Debt Projections For G7 Countries (2024-2029F)

Stock Comparison: Magnificent 7 Vs. 2000s Tech Bubble