Image Source:

Image Source:

US inflation failed to moderate as hoped, with housing costs, airfares, medical care, and recreation all keeping the run rate for month-on-month inflation hot. Their favored measure of inflation, the core PCE deflator, may be cooling nicely, but the mixed messages mean the Fed can’t relax, with little inclination for imminent rate cuts.

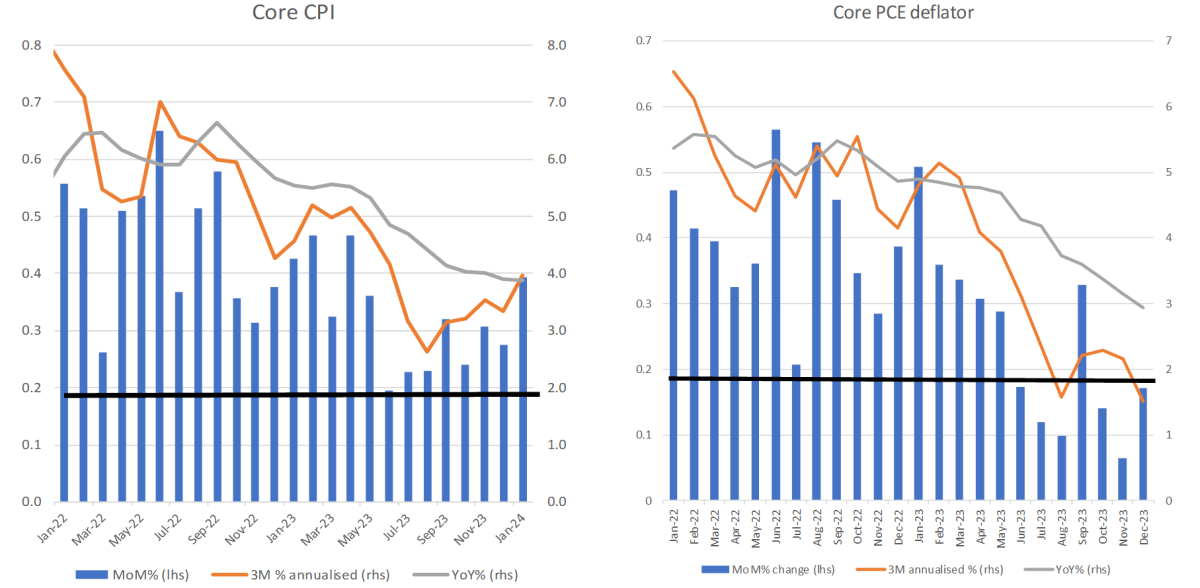

Inflation remains stickier than thoughtUS January CPI has come in on the high side of expectations, with headline up 0.3% MoM versus the 0.2% consensus while core rose 0.4% MoM versus the 0.3% market expectations. This means the annual rate of headline inflation falls to 3.1% from 3.4% and core remains at 3.9%.The details show the upside surprise coming from shelter, which increased 0.6% MoM, led by owners’ equivalent rent, which also increased 0.6%. Airline fares rose 1.4% MoM while medical care increased 0.5%, the same as recreation while education increased 0.4%. These last three are all the fastest rate of increase for a number of months. We did get good news on vehicle prices, which were flat on the month for new cars and down 3.4% for used vehicles, but the report is undeniably disappointing overall.Mixed messaging: Core CPI versus core PCE deflatorMoM%, 3M annualized and YoY% Source: Macrobond, ING

Source: Macrobond, ING

Fed remains wary of early rate cutsWhen looking at the core PCE deflator, which is tracking considerably lower as a measure of inflation, it again underscores the mixed messaging we are getting from the US data. The left-hand chart is core CPI from today, the right-hand chart is the Fed’s favored measure of core inflation, the core PCE deflator. What we want to see is the MoM% change (blue bars) to be consistently below the black line (0.17% MoM) to get inflation down to 2% year-on-year. We aren’t close on CPI, but we are clearly there on the core PCE deflator. Likewise, the 3M annualized rate looks great on the PCE deflator and rather worrying on the CPI measure.Nonetheless, today’s miss will embolden the Fed to signal it is in no hurry to cut interest rates with the market moving back to only fully pricing three 25bp rate cuts this year, the same as suggested by the Fed’s December dot plot of individual FOMC members with June the start point for cuts. That said, things can move fast and nothing is set in stone – it was only a few weeks ago that the market was pricing seven 25bp moves starting in March. Weak retail sales and industrial production numbers later this week may well contribute to a slight reversal in today’s big market moves that have seen the US 10Y move back above 4.25%.More By This Author:Turkey Sees A Modest Improvement In Its Current Account Deficit FX Daily: Lower US Inflation Can Ignite Real Rate Discussion The Commodities Feed: Middle Distillate Strength

Sticky US Inflation Reaffirms Fed Caution On Rate Cuts