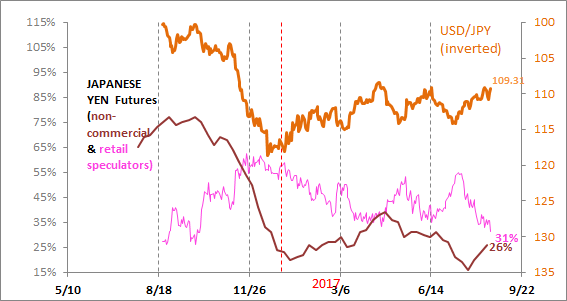

According to the latest COT (Commitment of Traders) report (as of August 15th), the most significant move in the FX futures positioning was once again with the Japanese yen, as the percentage of long (futures) positions of speculators improved for the 3rd straight week. This enabled the net percentage (of long positions) to edge higher to 26%, highlighting an improvement off the recent 2-year low. The number of gross short positions (vs the yen), fell for the 4th straight week, allowing for the net (position total) to increase by another 18K. According to retail trader data provided by Oanda Corporation, the retail population continues to fade yen strength, pushing the overall percentage of bulls down to 31%. While this is still near the year’s low (in terms of retail optimism for the yen), in both previous occasions that the percentage reached these (low) levels, the yen grinded higher the subsequent few weeks. A solid break below 108.67 would confirm a bearish and would expose the 107.85 (key Fibonacci retracement) to mid-105 region next. That said, if the broad dollar correction were to continue, a substantial base at 108.67 could be highlighted on price-action moving beyond the 111.00 handle (USD/JPY).

Â

The net long tally for euro (futures) speculators inched lower once again after having ticked-up the previous week. Price-action for EUR/USD edged down accordingly during that period (8/8 to 8/15) as euro bulls continue to consolidate recent 18-month highs. The gross long position dropped by over 10k and gross shorts edged up slightly, allowing for the net percentage (63% long) to dip. This potentially highlights a top or ceiling in terms of sentiment for large speculators. According to the latest data from Oanda Corporation, retail traders seem to be undecided with regards to the euro. That said, retail optimism has seemingly bottomed, suggesting that euro could endure a broader correction vs the USD, especially if support at the key 1.17 handle for the EUR/USD is compromised.