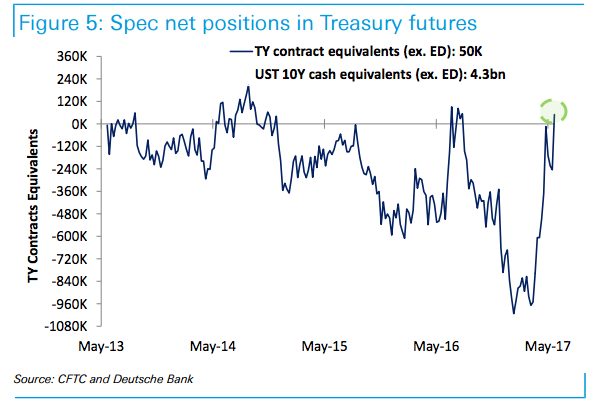

Well, if you’re the type of person who has been conditioned to believe that “smart†money positioning may be a contrarian indicator, then it might be time to short Treasurys (again).

Because the latest CFTC is out (current through Tuesday as usual) and specs have flipped net long in Treasury futs for the first time since July of last year, buying 301K contracts in TY equivs over the week.

(DB, CFTC)

As Bloomberg notes, “the position flip from short is consistent with the 5s30s curve flattening aggressively over the reporting weekâ€:

The TY net long is now 363K contracts, the highest since December 2007:

Â