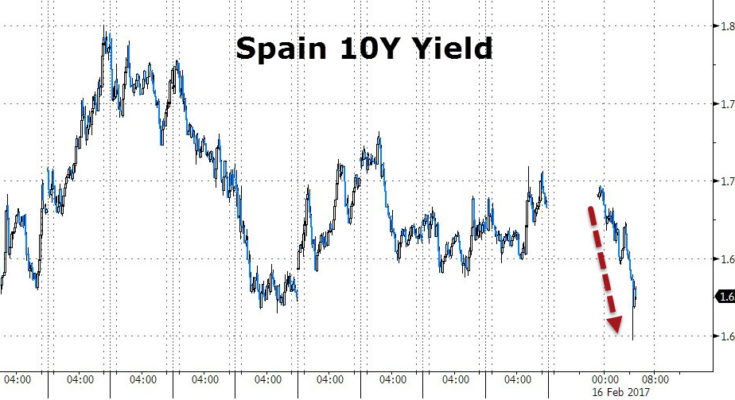

While typically uneventful, this morning the release of minutes from the ECB’s January 18-19 meeting prompted a spike in both French and Spanish bonds, with yields dropping between 6 and 8 bps after the ECB said that “limited and temporary deviations†from the capital key “were possible and inevitable.†As Bloomberg explains, the gains in these countries are due to their larger overall outstanding debt, as deviations from capital key suggests the ECB may end up buying more bonds from these countries.

Specifically, this is what the ECB stated::

Regarding the implementation details on the Governing Council’s December decision to permit asset purchases below the DFR “to the extent necessaryâ€, the choices outlined by Mr CÅ“uré were seen to primarily hinge on the relative weights to be given to the different criteria and restrictions attached to the APP. It was recalled that sticking to the issue and issuer limits had been assessed as most important in this regard. While significant weight was also placed on limiting deviations from the ECB’s capital key, it was also underlined that limited and temporary deviations were possible and inevitable. Thus, there was some room for a trade-off between relative deviations from the capital key across jurisdictions and limiting the extent of purchases below the DFR.

The result was immediate for both Spanish and French bonds:

(Click on image to enlarge)

(Click on image to enlarge)

In other minutes highlights, the ECB policy makers “widely agreed†to maintain stimulus at their latest meeting because “otherwise, recent encouraging developments in inflation expectations and the prospects for a sustained adjustment in inflation towards the Governing Council’s inflation aim could be put at risk.â€

The minutes added that “members widely shared assessment†that “underlying inflation pressures had remained subdued and signs of a convincing upward trend were still lacking†and noted that there was “broad agreement†to look through higher headline inflation.”