So what did we learn last week?

Well, we learned that despite what amounts to an institutionalized policy of suppressing vol, there’s only so much markets can take when it comes to political turmoil.

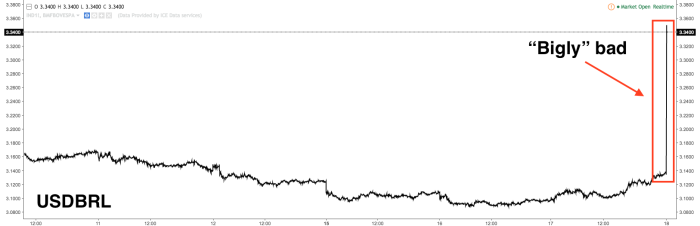

The S&P and the VIX finally met a near-term Waterloo on Wednesday following new revelations regarding what certainly looks like a concerted effort on the part of the Trump administration to obstruct justice. Then on Thursday, yet another corruption scandal rocked Brazil, sending the real plunging and triggering circuit breakers on the Bovespa.

Just when it looked like things had calmed down, a fresh set of headlines hit the tape on Friday afternoon that cast still more doubt on the Trump administration’s ability to remain intact in the face of increasingly aggressive investigations into alleged Russian collusion.

So while it looked, on the surface, like an “all’s well that ends well†type of thing, there was damage. The dollar, for instance, finally gave back all of its post-election gains and the 2s10s slope tells a similar story:

What then, should you expect in the week ahead?

Well, Barclays has some thoughts. Below, find excerpts from the bank’s latest, entitled “Ripples In The Sea Of Tranquility.â€

Via Barclays

While the scheduled events that carried the highest political risks are behind us, the lurking “sharks†have surfaced, temporarily breaking the calm in the sea of tranquility.