Add some dividend growth horsepower to your portfolio with any of these seven REITs increasing their dividends by double digits and start collecting a growing stream of income.

One of my goals for 2016 is to add some more dividend growth horsepower to my dividend-focused investing strategy. My best results in 2015 have been from those companies that are growing their dividend payments by 15% per year or more. After a year with a lot of frustration concerning share prices, even as the dividend payments stayed strong, I want to add a larger shot of dividend growth going forward into the New Year.

In theory the math of dividend growth is pretty straight forward. For the yield on a stock to remain constant, the share price must increase by the same rate as the dividend growth. To illustrate, a hypothetical REIT yields 5%, and is growing its dividend rate by 10% per year. After a year, to still yield 5% the share price must be up by the 10% in dividend growth. The 10% capital gain plus the 5% (actually a little more if the dividend increases have been spaced out) yield gives a 15% total return. That’s a nice stock market result in almost anyone’s book.

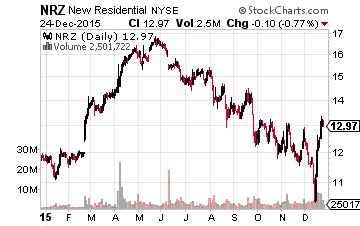

Of course, if you have owned dividend paying stocks, you know that the market is not a calculator and is not even close to logical. Market participants are always looking for different reasons why share price should be going up or down. A good example isÂ

New Residential Investment Corp (NYSE: NRZ). The current dividend is now 21% higher than the rate investors were earning a year ago. Yet the NRZ share price is down 3.7% over the same period.

The better news is that NRZ now yields 14.1% compared to 11.7% a year ago. At some point the market will actually realize that NRZ is growing its dividend and will push the share price up, producing the total return the math demands. The dividend yield plus dividend growth return expectation will work out over the longer term.

For example, healthcare REITÂ Ventas, Inc. (NYSE: VTR)Â is a steady dividend grower, with 8.6% average annual dividend growth over the last 10 years. The result has been 15.4% compounded annual return, right through the 2008-2009 bear market and producing a 320% total return for the 10 years.