Idea of the Day

From here to the end of the month is likely to be characterised by tight ranges for the most part, with some scope for volatility around what events are scheduled. Inflation data in Japan is seen later this week and changes to savings legislation are focusing minds on the potential for further weakening of the yen in the early part of 2014. The main point to note going into year-end is that the Fed has started tapering, the world has not ended and the US dollar is only 0.5% firmer versus pre-tapering levels. For today, US data risks are low meaning that volatility is likely to retain the lower levels seen overnight.

Data/Event Risks

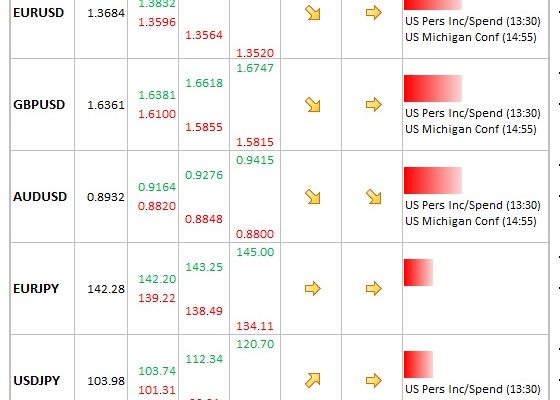

USD: Today’s data not a major risk event for the dollar, with just personal income and spending. Michigan confidence just the final release, so is also not likely to move markets.

Latest FX News

AUD:Â Some support for the Aussie during Asia trade, allowing it to move further away from some of the recent lows, but ranges were naturally tight. No key data/events for the remainder of the year.

EUR:Â Briefly above the 1.37 during Friday going in the European close, but has settled below during the Asia session. Gold: Has managed to climb back above the 1,200 level during Asia trade, but overall looking weak and only just above the 1,180.57 low for the year.

Further reading:

AUD/USD Forecast Dec. 23 – 30

Fed has started tapering