Majority of the Asian markets remained closed. Stock markets in the US & Europe closed their previous session in red. Meanwhile, Indian share markets have opened the trading day on a weak note. The BSE Sensex is trading lower by 129 points while the NSE Nifty is trading lower by 41 points. The BSE Mid Cap index opened the day down by 0.1% and BSE Small Cap index have opened the day up by 0.3%. The rupee is trading at 67.95 to the US$.

Sectoral indices have opened the day on a mixed note with realty, oil & gas stocks witnessing maximum buying interest. Whereas, banking and FMCG stocks have opened the day in red.

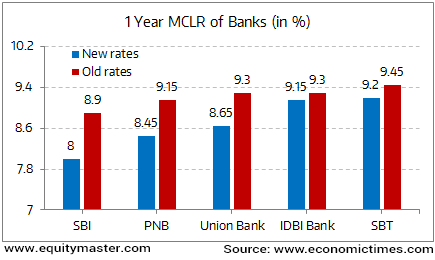

According to an article in a leading financial daily, State Bank of India (SBI) has cut its lending rates by 90 basis points for maturities ranging from overnight to three-year tenures, after experiencing a surge in deposits.

The SBI move comes after Prime Minister Narendra Modi on Saturday admonished banks to “keep the poor, the lower middle class, and the middle class at the focus of their activities,” and to act with the “public interest” in mind. Among the steepest interest rate cuts in a long time, the move is aimed at boosting loan growth, which has fallen to a multi-decade low.

After the move, its so-called overnight marginal cost of funds-based lending rate (MCLR) fell to 7.75% from 8.65%, while three-year loan rates will now be 8.15% from 9.05% previously. This is the second rate cut by the SBI in two months, as the lender had reduced MCLR by 15 bps in November. Following the withdrawal of the old Rs 500 and Rs 1000 notes, banks’ loan growth has slumped, with economic activity taking a hit.

Banks Slash Interest rates

Following this, Union Bank of India and Punjab National Bank also announced cuts ranging from 60 to 90 basis points.

Meanwhile, The Economic Times, reported that following the recent spurt in oil prices to well over US$50 a barrel, Indian Oil Corp (IOC) on Sunday hiked prices of petrol by Rs 1.29 a litre, and of diesel by 97 paise, both at Delhi and effective from midnight, with corresponding increases in other states.