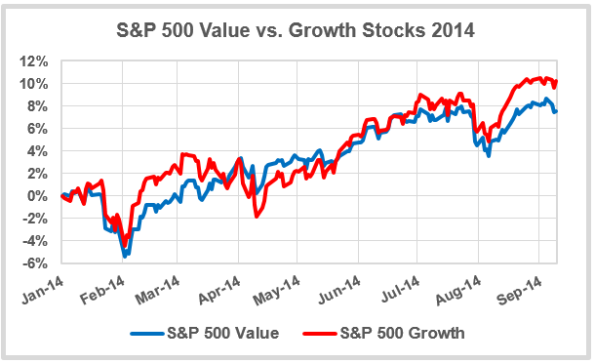

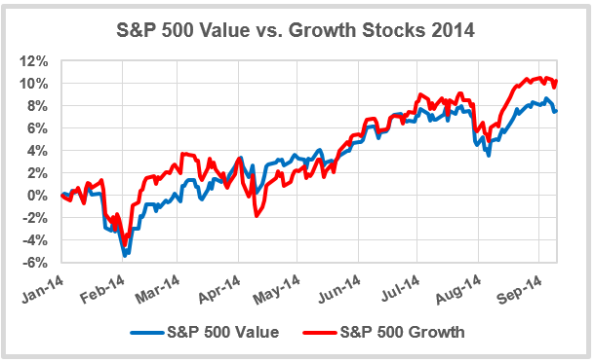

The usually-reliable crystal ball of sector analysis suggests no more than tepid enthusiasm for stocks thus far in 2014. Although growth stocks have finally surged ahead of value stocks:

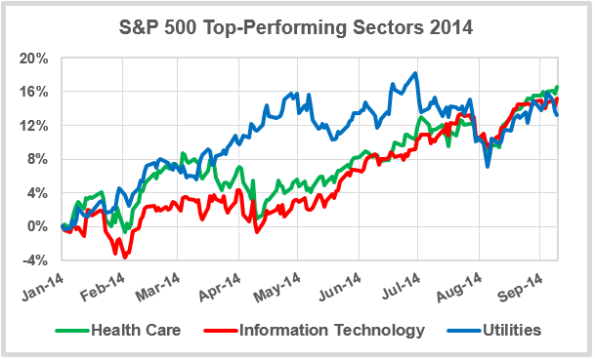

The individual leading sectors remained tilted towards the defensive, with only Information Technology matching the performance of Health Care and Utilities, which are typically thought to be more high-yield, risk-off sectors:

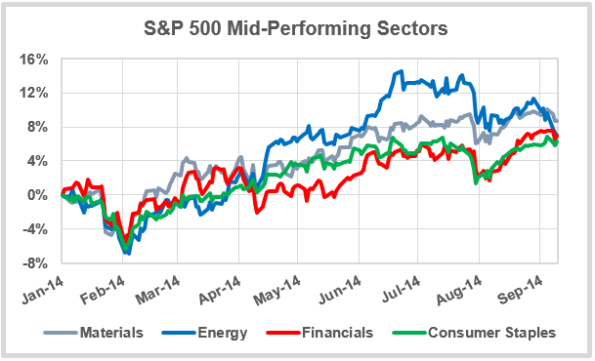

Filling out the middle of the pack we have Materials, Energy, Financials and Consumer Staples:

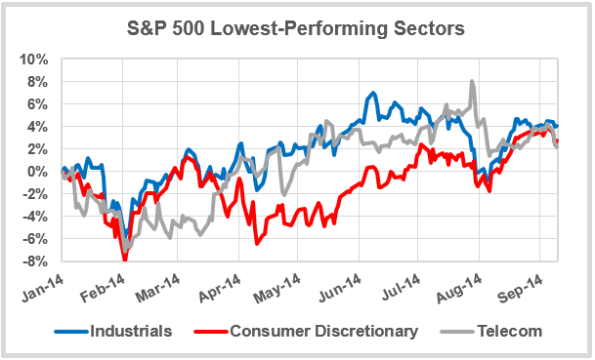

With traditionally risk-on sectors Industrials and Consumer Discretionary joining Telecom at the bottom of the pack:

Thus far in 2014, sector performance suggests more of a risk-off, reach-for-yield stock market, with Health Care and Utilities decisively outperforming more risk-on sectors like Energy, Industrials and Consumer Discretionary. It is also noteworthy that typically-safer Consumer Staples stocks have outperformed Consumer Discretionary stocks. Although sector performance such as this is not unusual following the outsized gains stocks posted in 2013, it suggests a slightly fatigued, over-extended market overall. With the Fed more likely to continue leaning towards a more hawkish stance on further stimulus and the level of interest rates in its upcoming meeting, stocks appear as vulnerable for a correction as they have all year.