Image Source:

Image Source:

What Can We Learn from Sector ETFs?

A previous post of mine focused on the 3rd quarter rotation from large cap-weighted growth ETFs to index ETFs that were more value-oriented, equally weighted, and/or mid- and small-cap focused. Sector ETFs are often used for rotation strategies in addition to being vehicles for long-term investment.There are 132 sector ETFs in VettaFi’s etfdb.com that access US-listed stocks. The first thing that surprised me in this research was that neither iShares nor SPDR was the leader in sponsoring US sector ETFs. That honor goes to Invesco with 49, followed by SPDR with 39 and iShares with 34.However, many ETFs within this aggregation access subsectors (e.g., biotech) and specific industries (e.g., regional banks), while others combine sectors with “smart beta” factors. Invesco’s sector ETFs all fall into these categories, including full sets that combine sectors with equal-weighting and with price momentum.This article will focus primarily on broad sector ETFs, especially homing in on sectors with the same name as the sectors of the Global Industry Classification Standard (GICS) introduced by Standard and Poor’s jointly with MSCI, the two dominant index providers in the world.But, we do not limit this study to ETFs that use one of those providers as the basis for their sectors. In fact, one purpose of this article is to highlight the differences between these ETF families along with examining performance trends.All 4,200+ stocks, 16 sector groups, 140 industries, and 600+ ETFs have been updated.Most sector performance reviews focus on the Select Sector SPDRs sponsored by State Street Global Advisors (SSgA). Select Sector SPDRs are a collection of 11 sector index funds that divide the S&P 500. Each ETF has an expense ratio of 9 basis points, or 0.09%.These were the first sector in the US markets. 9 of the 11 have inception dates of Dec. 19, 1998. The 9 Select Sector SPDRs with that launch date are listed below.  Two other Sector SPDR ETFs were created and began trading much later. GICS added the Real Estate Sector about a dozen years ago. In October 2015, SPDR Sponsor SSgA launched to represent the S&P 500 stocks corresponding to the companies classified by the Real Estate GICS code.In 2018, in order to handle a number of weighting issues brought to Standard and Poor’s Global and MSCI by institutions, a new sector, Communications Services, was added. At the same time and in a delayed response to the fact that the old “Baby Bell” companies no longer existed, the Telecommunications Sector was removed.Most of that sector’s remaining stocks were reclassified as Communications. In addition, many major internet companies used by individuals to communicate with other individuals, such as Meta and Alphabet, were moved from Technology to Communications. On June 18, 2018, was created to represent the Communications Sector.So, now let’s take a look at the rates of return for these 11 ETFs for a few different periods as of Oct. 31, 2024. The bulk of this data comes from VettaFI’s excellent ETFDb Pro screening tool.

Two other Sector SPDR ETFs were created and began trading much later. GICS added the Real Estate Sector about a dozen years ago. In October 2015, SPDR Sponsor SSgA launched to represent the S&P 500 stocks corresponding to the companies classified by the Real Estate GICS code.In 2018, in order to handle a number of weighting issues brought to Standard and Poor’s Global and MSCI by institutions, a new sector, Communications Services, was added. At the same time and in a delayed response to the fact that the old “Baby Bell” companies no longer existed, the Telecommunications Sector was removed.Most of that sector’s remaining stocks were reclassified as Communications. In addition, many major internet companies used by individuals to communicate with other individuals, such as Meta and Alphabet, were moved from Technology to Communications. On June 18, 2018, was created to represent the Communications Sector.So, now let’s take a look at the rates of return for these 11 ETFs for a few different periods as of Oct. 31, 2024. The bulk of this data comes from VettaFI’s excellent ETFDb Pro screening tool.  The battle for the top spot year-to-date has been very close, with just 8/100 of one percent separating the top two performers. Communications Services (), at 28.09%, has a slight edge over Utilities (), at 28.01%. Finance () is in third place, with less than a 2.00% differential. Two other sectors are also up more than 20% this year: Technology () and Industrials ().The worst two performing sectors year to-date are still handily beating inflation, one of the primary reasons savers are urged to invest in equities. Health care () is up 10% and Energy () is up 7.3%, while inflation is on track to finish 2024 well below 4%. Sector selection aside, it has been a great year through Oct. 31 to have been invested in US equities, especially large-caps in the S&P 500.Looking at longer time frames, XLK is the top performer for the five-year period with a compound annualized rate of nearly 24% while Real Estate (XLRE) has the worst five-year return, about 3.5% per annum. On a three-year basis with 1/3 of the weight given to the sharp downturn in 2022, it’s a different story altogether. XLE fared best in that particular interval, with a 19% annualized return, in contrast to XLRE, with a virtually flat return (0%) for the period.One observation distinguishing 2024 thus far is that 10 months into a go-go year for stocks, Utilities () is the second top performer and virtually tied for the top performer this year. This is highly unusual for the sector ETFs in the equity market.The handful of other years in the past 50 years that Utilities were even among the top five sectors in price gain, it was because market returns were in the down-to-flat category. This year, utilities have been behaving like growth stocks with investors buying them for growth, not just dividend yield.In contrast, the other two sector ETFs with higher-than- yields, XLE and XLRE, are 10th and 8th in year-to-date returns, respectively. In terms of five-year weekly Beta, the ETF’s price volatility with respect to benchmark index movements, Utilities is lowest, at 0.52, while Consumer Staples () is second lowest, at 0.57. The highest market-relative volatility sector ETF is XLE with a Beta of 1.36The other major provider of cap-weighted Sector ETFs is the Vanguard Group. There are several features that consistently distinguish Vanguard’s sector ETFs from Select Sector SPDRs:

The battle for the top spot year-to-date has been very close, with just 8/100 of one percent separating the top two performers. Communications Services (), at 28.09%, has a slight edge over Utilities (), at 28.01%. Finance () is in third place, with less than a 2.00% differential. Two other sectors are also up more than 20% this year: Technology () and Industrials ().The worst two performing sectors year to-date are still handily beating inflation, one of the primary reasons savers are urged to invest in equities. Health care () is up 10% and Energy () is up 7.3%, while inflation is on track to finish 2024 well below 4%. Sector selection aside, it has been a great year through Oct. 31 to have been invested in US equities, especially large-caps in the S&P 500.Looking at longer time frames, XLK is the top performer for the five-year period with a compound annualized rate of nearly 24% while Real Estate (XLRE) has the worst five-year return, about 3.5% per annum. On a three-year basis with 1/3 of the weight given to the sharp downturn in 2022, it’s a different story altogether. XLE fared best in that particular interval, with a 19% annualized return, in contrast to XLRE, with a virtually flat return (0%) for the period.One observation distinguishing 2024 thus far is that 10 months into a go-go year for stocks, Utilities () is the second top performer and virtually tied for the top performer this year. This is highly unusual for the sector ETFs in the equity market.The handful of other years in the past 50 years that Utilities were even among the top five sectors in price gain, it was because market returns were in the down-to-flat category. This year, utilities have been behaving like growth stocks with investors buying them for growth, not just dividend yield.In contrast, the other two sector ETFs with higher-than- yields, XLE and XLRE, are 10th and 8th in year-to-date returns, respectively. In terms of five-year weekly Beta, the ETF’s price volatility with respect to benchmark index movements, Utilities is lowest, at 0.52, while Consumer Staples () is second lowest, at 0.57. The highest market-relative volatility sector ETF is XLE with a Beta of 1.36The other major provider of cap-weighted Sector ETFs is the Vanguard Group. There are several features that consistently distinguish Vanguard’s sector ETFs from Select Sector SPDRs:

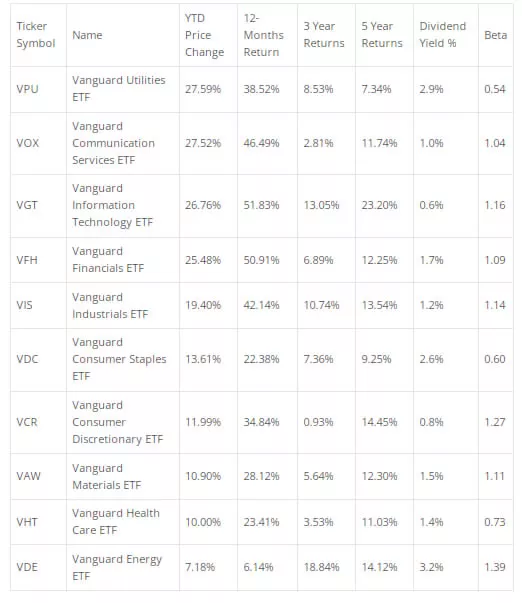

When it comes to bottom line performance using the same categories as before, did any sectors perform significantly better using the Vanguard ETFs than the Select Sector SPDRs from SSgA? Let’s take a look. The bottom line is that most of the returns for each period are within 100 basis points or 1.00% differentials. That, however, is enough to create some ordinal changes on year-to-date returns. Using the Vanguard sector ETFs, Utilities () is at 27.59%, just ahead of XLU at 27.52%. Third and fourth places also get reversed.Using SPDRs, Financials () edged ahead of Technology (XLK). In the Vanguard family, Information Technology (VGT) finished third and Vanguard Financials () finished fourth.However, these slight discrepancies only applied to the year-to-date period. The relative order in the three- and five-year periods for both families was preserved. The dividend yields and Beta for the analogous ETFs were all very close as well, although very few numbers were identical to two digits.For most reading this, the choice between Select Sector SPDRs and Vanguard Sector ETFs is a no-lose decision. Both are excellent products for long-term deployment or tactical trading. From a benchmarking perspective, they both painted similar portraits of US equity market sector performance during the past one-, three-, and five-year periods.A bigger question for investors is which sectors to focus on going forward. In the wake of the election, there has been no shortage of analysis on what this all portends for the market. The market itself wasted little time in demonstrating its exuberance.After the initial rally, let’s look at ValuEngine’s predictive ratings in an attempt to glean what could come next and whether there is any difference in the ratings for analogous sector ETF.These ETFs earned 5 (Strong Buy) ratings:

The bottom line is that most of the returns for each period are within 100 basis points or 1.00% differentials. That, however, is enough to create some ordinal changes on year-to-date returns. Using the Vanguard sector ETFs, Utilities () is at 27.59%, just ahead of XLU at 27.52%. Third and fourth places also get reversed.Using SPDRs, Financials () edged ahead of Technology (XLK). In the Vanguard family, Information Technology (VGT) finished third and Vanguard Financials () finished fourth.However, these slight discrepancies only applied to the year-to-date period. The relative order in the three- and five-year periods for both families was preserved. The dividend yields and Beta for the analogous ETFs were all very close as well, although very few numbers were identical to two digits.For most reading this, the choice between Select Sector SPDRs and Vanguard Sector ETFs is a no-lose decision. Both are excellent products for long-term deployment or tactical trading. From a benchmarking perspective, they both painted similar portraits of US equity market sector performance during the past one-, three-, and five-year periods.A bigger question for investors is which sectors to focus on going forward. In the wake of the election, there has been no shortage of analysis on what this all portends for the market. The market itself wasted little time in demonstrating its exuberance.After the initial rally, let’s look at ValuEngine’s predictive ratings in an attempt to glean what could come next and whether there is any difference in the ratings for analogous sector ETF.These ETFs earned 5 (Strong Buy) ratings:

These ETFs earned 4 (Buy) ratings:

Regardless of the family, our predictive model gave Strong Sell ratings of 1 to Consumer Staples (XLK and VGT), along with Energy (XLE and VDE).More By This Author:SPY, The Pioneering ETF, Tops $600B AUM – Good News And Bad NewsA Sea Change In Leadership Or Just A Pit Stop? Exploring Canadian Opportunities