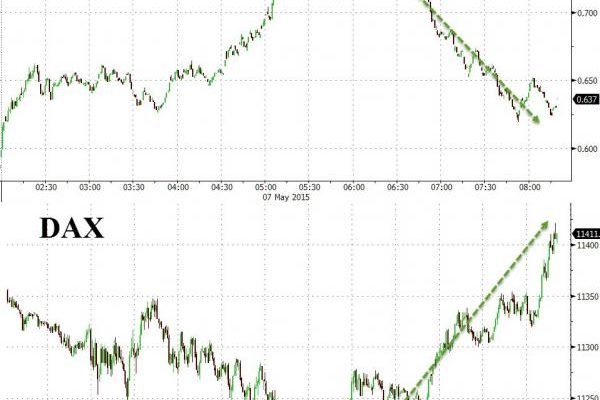

Overnight “manic-selling” in global bond markets (and turmoil in stock markets) has been met – suddenly – this morning by “panic-buying” as mysteriously liquid buyers lift stocks back into the green and send bond yields plunging (right after Euronext breaks)…

Europe…

Â

Â

And US…

Â

Â

As Bloomberg adds,

“At some point the stress on stocks, risk assets, from either earnings fears or higher rates surely has a stalling effect on the panic in the bond market and we say panic with emphatical deliberation. Nothing excuses this rout beyond the emotions of pained positions which, largely, are in markets other than Treasuries,â€Â CRT strategist David Ader says in note.

“Cooler heads, and we count ourselves among them, point to liquidity and VAR constraints on dealer desks that make these moves more exaggerated than they might have been a few years agoâ€

Market is in a mode of “high volatility with no dealer liquidity and easy excuses but not, yet, thematic ones†as “gyrations of the past month or so have thrown people into a tizzy and certainly upset positions elsewhere, like in Bunds and the dollar, but we’re are just the derivative and don’t see that things have changed so much to warrant more of a selloffâ€

Charts: Bloomberg