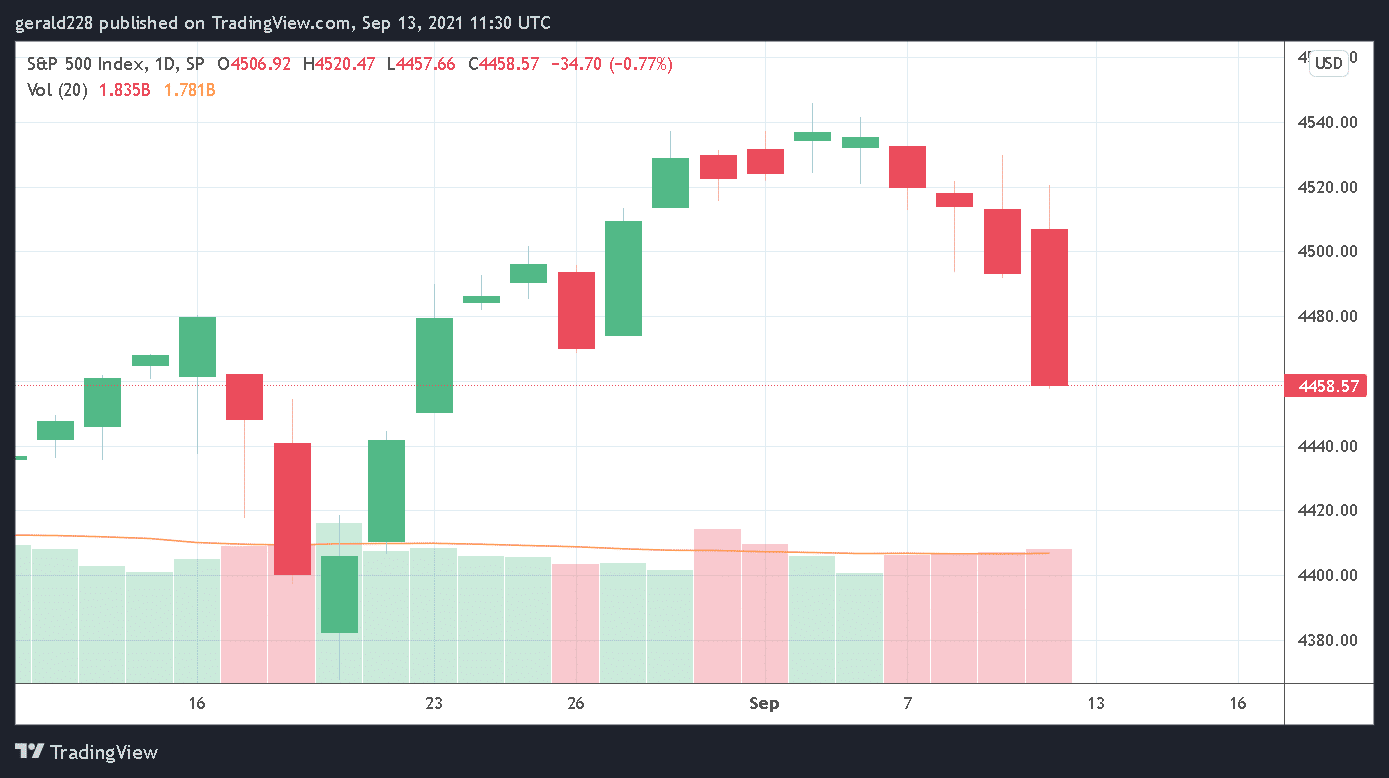

The S&P500 price is in steep decline and it is expected to continue losing this week. Considerable market uncertainty, as well as worries about the Covid19 situation, continue to plague investor confidence. The economic tapering that was supposed to begin very soon according to Fed Chair Jerome Powell’s statements seems to have been kicked into the long grass.Analysts now seem to think that after an unprecedented bull run where the S&P500 price gained almost 8%, it is now due for a heavy correction. Vague statements about economic policy are not helping whilst the economic recovery has clearly stalled. The sharp rise in Covid19 cases and the sluggish pace of vaccinations are definitely causing investor jitters.If you want to start trading forex then you should take a look at this Trading Forex For Beginner’s GuideShort Term Prediction For S&P500 price: More Downside Expected As Markets Tremble The S&P500 price is looking at a rough ride this week as it continues to lose steam and momentum. After reaching the 4600 all time high level earlier last week, the SPX descended pretty fast and ended Friday’s session at the 4458 level or a drop of almost 3% over just 3 days. This steep decline demonstrates the uncertainty in the markets as investors continue to be hesitant.If a bullish thesis would play out (unlikely at this point), the S&P500 price would probably once again tag the 4500 level. Further buying pressure could push this up to the 4530 mark, where resistance would be encountered. This scenario looks increasingly unlikely with all the problems currently in the market at present.The bearish scenario is much more likely at present. If this were to continue panning out, the S&P500 price would most likely test the 4400 level as stocks continue to feel the brunt. A further sell-off may not be discounted here either with further bi-monthly lows being tested. However, it is good to point out that the S&P500 is only around 1% off its all-time high which is quite a remarkable performance in the circumstances.If you wish to enter the forex market, have a look at these Top Forex Brokers.Long Term Prediction For SPX: Investor Jitters May Linger But Still Bullish Overall Considering the Huge Gains Made This YearAlthough the week ahead looks negative for the S&P500 price, a mid-month pullback is nothing new. The decline appears set to continue but with buyer interest increasing, some of these may get in at a discount with the mood changing fast.Among the events to look out for which could have an effect on the long-term prospects of the S&P500 price, US CPI is crucial. It appears that economic growth has peaked so it will be difficult for an immediate reversal. Higher consumer prices will have alarm bells ringing for possible stagflation with risks now tilted firmly on the downside.Long term, the S&P500 price is still looking towards the 5000 level by the end of the year. Further indications of economic tapering should also give a snapshot into how the SPX is expected to perform.

The S&P500 price is looking at a rough ride this week as it continues to lose steam and momentum. After reaching the 4600 all time high level earlier last week, the SPX descended pretty fast and ended Friday’s session at the 4458 level or a drop of almost 3% over just 3 days. This steep decline demonstrates the uncertainty in the markets as investors continue to be hesitant.If a bullish thesis would play out (unlikely at this point), the S&P500 price would probably once again tag the 4500 level. Further buying pressure could push this up to the 4530 mark, where resistance would be encountered. This scenario looks increasingly unlikely with all the problems currently in the market at present.The bearish scenario is much more likely at present. If this were to continue panning out, the S&P500 price would most likely test the 4400 level as stocks continue to feel the brunt. A further sell-off may not be discounted here either with further bi-monthly lows being tested. However, it is good to point out that the S&P500 is only around 1% off its all-time high which is quite a remarkable performance in the circumstances.If you wish to enter the forex market, have a look at these Top Forex Brokers.Long Term Prediction For SPX: Investor Jitters May Linger But Still Bullish Overall Considering the Huge Gains Made This YearAlthough the week ahead looks negative for the S&P500 price, a mid-month pullback is nothing new. The decline appears set to continue but with buyer interest increasing, some of these may get in at a discount with the mood changing fast.Among the events to look out for which could have an effect on the long-term prospects of the S&P500 price, US CPI is crucial. It appears that economic growth has peaked so it will be difficult for an immediate reversal. Higher consumer prices will have alarm bells ringing for possible stagflation with risks now tilted firmly on the downside.Long term, the S&P500 price is still looking towards the 5000 level by the end of the year. Further indications of economic tapering should also give a snapshot into how the SPX is expected to perform.

S&P500 Price Prediction: Reversal Downwards As More Drops Expected