S&P futures, European stocks and bond yields all fell in early trade alongside oil and the euro after the latest Fed minutes expressed concern over weak U.S. inflation, while Asian equities rose overnight ahead of WalMart earnings and the latest ECB minutes. Gold rose as high as $1,290 before fading most gains as the USD/JPY rebounded. Fund futures are now pricing in about a 40% chance the Fed will raise rates by December, compared to 50% before the Fed’s minutes.

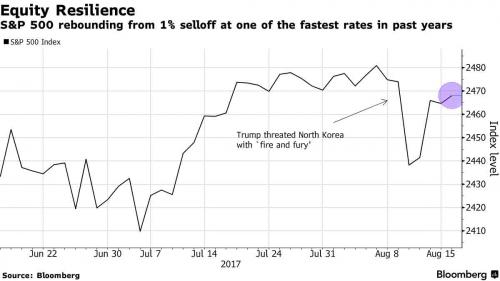

Last week’s market turmoil and resultant near record jump in volatility in the wake of heightened tensions between the U.S. and North Korea has continued to ease, bringing down gauges of equity and bond volatility and repairing most of the damage done to stock markets, in fact as Bank of America showed, the retracement in the VIX on Monday was among the fastest on record.

But political angst isn’t over; investors continue to watch the political train-wreck in Washington where President Trump disbanded two high-profile business advisory councils amid the fallout from his response to the weekend violence in Virginia.

“Trump dissolving his major business groups makes the investment community even more pessimistic because this sets the stage for even more failure for him,” Naeem Aslam, chief market analyst at Think Markets in London, wrote in a note.

Lost in the political noise was the July FOMC minutes, where the most notable takeaway was the reference to “most participants expected inflation to pick up over the next couple of years….and to stabilize around the 2% objective over the medium termâ€. However, many participants “saw some likelihood that inflation might remain below 2% for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside.†The debate on inflation echoed recent comments made public by various Fed presidents, while some members noted the “committee could afford to be patient….in deciding when to increase the rates further and argued against additional adjustments until incoming information confirmed that the recent low inflation were not likely to persistâ€. However, those comments were balanced by the observation that “…some other participants were more worried about risks arising from a labour market that had already reached full employment and was projected to tighten further from the easing in financial conditionsâ€. Elsewhere, on the balance sheet unwind topic, “several†members favoured an announcement in the July meeting, but most preferred to defer that decision to the next meeting in September.

With concerns about weak inflation in the air, the Stoxx 600 Index was down 0.1%, with declines in banking shares offsetting advances in healthcare stocks. Germany’s DAX, France’s CAC 40 and the UK’s FTSE 100 all fell 0.1%. Yesterday’s Reuters’ trial balloon, according to which Mario Draghi would not say anything of note next week during the Jackson Hole conference, weakened the euro, which traded as low at 1.1700 this morning and gave support to fixed income assets with European government bond yields dropping, and the 10Y Bund yield down nearly 2 bps to 0.42%, down from Wednesday’s high of 0.47%. Most other euro zone yields fell 1-2 basis points.

In currencies, the euro slid before the release of the minutes from the last ECB meeting. Most Asian currencies rose overnight, with the Korean won up 0.3% after tensions over North Korea continued to ease. Overnight, the yen gained for a second day as the dollar decline on declining US rate hike expectations. The Australian dollar rose a second day against the U.S. dollar to reach the highest in nearly 2 weeks after July employment data beat estimates while prior month data was revised higher and iron ore prices erase week-to-date losses. In Europe, the pound rose against the euro after strong U.K. retail sales data.

In commodities, London copper, aluminum and zinc hit multi-year highs on expectation China’s reform of its metals industry will curb supply against a backdrop of robust demand. Gold and tin were among the best performing metals, and zinc traded near a 10-year high.Oil prices edged higher after new data showed U.S. crude stocks have fallen by 13 percent from a peak in March. Brent crude futures were at $50.36 per barrel, up 0.2 percent from their last close.

Today’s data include jobless claims, Philadelphia Fed Business Outlook and industrial production. Wal-Mart, Gap, Ross Stores and Madison Square Garden are among companies reporting earnings.

Bulletin Headline Summary from RanSquawk

- Choppy GBP reaction to UK retail sales

- Financial leading the declines in Europe post last night’s FOMC minutes

- Looking ahead, highlights include ECB minutes, US Philly Fed and jobless claims

Market Snapshot

- S&P 500 futures down 0.1% to 2,465

- STOXX Europe 600 down 0.1% to 378.62

- MSCI Asia up 0.5% to 159.86

- MSCI Asia ex Japan up 0.5% to 526.58

- Nikkei down 0.1% to 19,702.63

- Topix down 0.07% to 1,614.82

- Hang Seng Index down 0.2% to 27,344.22

- Shanghai Composite up 0.7% to 3,268.43

- Sensex up 0.4% to 31,888.42

- Australia S&P/ASX 200 down 0.1% to 5,779.21

- Kospi up 0.6% to 2,361.67

- German 10Y yield fell 1.0 bps to 0.435%

- Euro down 0.3% to $1.1738

- Italian 10Y yield unchanged at 1.755%

- Spanish 10Y yield fell 1.0 bps to 1.454%

- Brent futures down 0.2% to $50.17/bbl

- Gold spot up 0.3% to $1,287.08

- U.S. Dollar Index up 0.2% to 93.70