Small cap companies have underperformed their large-cap peers in the past few years as most of them have struggled in a high-interest-rate environment. For example, the S&P 500 index and the Nasdaq 100 have had total returns of over 72% in the last five years, while the Russell 2000 index has returned 57.8% in this period. Some analysts believe that small cap companies could do well in the coming months as interest rates reverse and as the US economy avoids a hard landing. These catalysts could push more investors to the Russell 2000 index, which tracks the biggest small-cap firms in the United States.

IWM vs RYLD ETFs

Investors seeking access to small cap companies have two main assets to invest in. The most popular one is the iShares Russell 2000 ETF, which is a fund with over $71 billion in assets. The IWM ETF is a passive fund that tracks 2000 small and medium-sized companies across all sectors. Most companies in the fund are in the financials segment and are followed by firms in the healthcare, industrials, technology, and consumer discretionary sectors. This fund, therefore, differs from the other popular ETFs like the Invesco QQQ and S&P 500 that are mostly made up of technology companies. The biggest companies in the ETF are FTAI Aviation, Vaxcyte, Sprouts Farmers Market, Insmed, Fabrinet, and Fluor Corp. FTAI Aviation is a leading company in the maintenance, repair, and exchange of aircraft engines. Its stock has jumped by more than 200% this year, helped by the increased demand for flying. Vaxcyte, a company in the vaccine industry, has soared by over 150% this year, while Sprouts Farmers Market has soared by almost 170%. The IWM ETF is a cheap fund with a 0.19% expense ratio.The Russell 2000 Covered Call ETF (), on the other hand, is an active fund with a 0.60% expense ratio. It achieves its goal by at least 80% of its assets in the Cboe Russell 2000 BuyWrite index, which tracks companies in the index. According to its website, it has invested $1.46 billion in the Global X Russell 2000 ETF. It has also invested about $15.4 million in cash. Its other investments are in companies like Inhibix, Novartis, and Cartesian. The fund then generates its returns by selling call options of the Russell 2000 index, which are held until expiration.Therefore, the fund’s goal is to ensure that it benefits when the Russell 2000 index is rising. It then uses the call options to generate monthly returns, through the premium it receives.As such, the RYLD generates a superior dividend income compared to the IWM. It has a dividend yield of 12% compared to IWM’s 1.4%.

Focusing on the total return

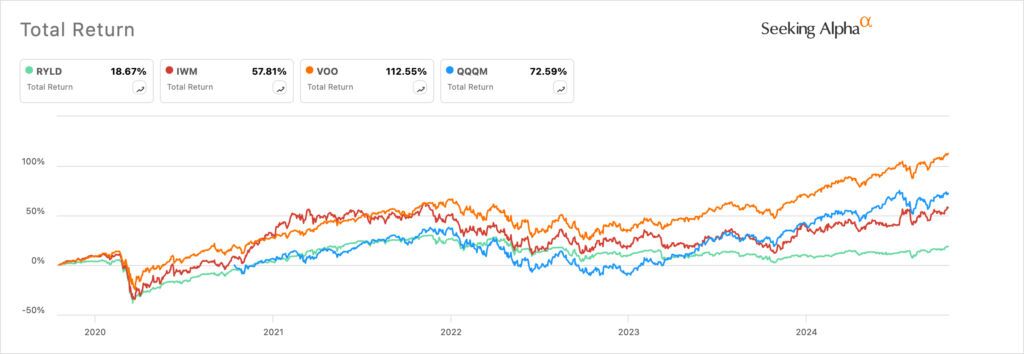

The RYLD ETF generates more dividends compared to the IWM ETF, making it more ideal for investors seeking good monthly income. If the yield sticks, it means that an investor with $10,000 allocated in the fund, will make a gross return of $1,200 annually. With fees and taxes included, the return will be smaller than that though. On the other hand, the same investment in the IWM ETF, will bring in less than $150 annually. However, historical data shows that the IWM fund is a better investment than the RYLD when you consider the total returns. For example, the IWM ETF has risen by 13.4% this year, while the RYLD fund has risen by 7.7%. The same happened in the last five years when the IWM returned 57% while the IWM returned 18.6%. (Click on image to enlarge)

Therefore, if your goal is to generate more returns investing in small-cap companies, then the RYLD fund is a better investment by far. Better still, historical data shows that mainstream funds that track the S&P 500 and Nasdaq 100 indices do much better, as shown above.More By This Author:

RYLD Yields 12%, IWM 1.1%: Which Is The Better Russel 2000 ETF?