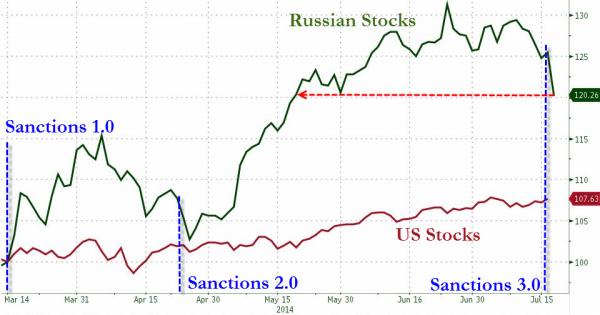

The Russian Ruble slumped 1.6% today, its biggest drop in over 4 months as investors kneejerk-reacted to the US latest round of restricted-funding-access sanctions. The Ruble is back at 2-month lows against the USD. The bonds of several of the sanctioned companies are also breaking down with Rosneft yields up 89bps at 6.22% and Novatek yields surging to 6.44% as even though Fitch confirms these firms can manage their own cash needs through 2015, as one analyst notes, “the lack of ability to raise long-term dollar funding will become a big economic limitation for all of them.” The broad Russian stock market is also tumbling, down to 2-month lows (though still notably above the US markets since sanctions began).

Sanctions 3.0 are having their normal short-term negative effect…

Â

as The Ruble is also being sold notably…

Â

Â

We wonder how long before BRICS Bank steps in to provide ‘temporary’ funding…Â and just how quickly Putin’s “boomerang” will hit if this selling continues.

Â