Below are the latest charts of the Ukrainian hryvnia, the Russian ruble, the stock markets of both countries and the default probabilities indicated by CDS spreads (standard recovery assumption of 40%).

Noteworthy is that stock markets in both countries have initially declined sharply on Friday, only to recover in late trading. As of Monday’s open, Ukrainian stocks were roughly unchanged, while Russian stocks were strengthening in spite of the threat of further EU sanctions (which are likely to be toothless in the bigger scheme of things anyway). Both the ruble and the hryvnia have been weak lately. The hryvnia has initially strengthened on the outlook for IMF funding, but has since given back some of that recovery. The ruble continues its recent downtrend, but the momentum has probably been slowed by the recent repo rate hike (+150 bp to 7%). The ruble currency area is about to increase, as it will shortly include the Crimea.

Default probabilities on the sovereign debt of both countries keep rising as CDS spreads continue to be bid up.

Currencies:

Hryvnia ($/UAH), daily – weakening once more – click to enlarge.

A long term chart of the hryvnia showing the moves since the 2008 crisis. The currency has never properly recovered from the crisis-induces weakness. One could say it is lurching from crisis to crisis … – click to enlarge.

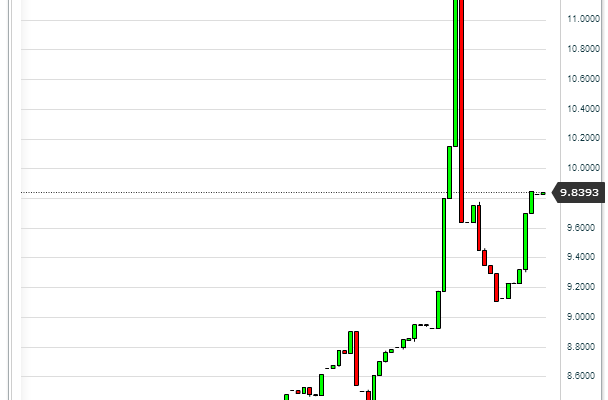

The Russian ruble ($/RUB), daily – still in a downtrend, but the momentum seems to be weakening in light of the recent rate hike – click to enlarge.

A long term chart of the ruble, covering the same time span as the LT hryvnia chart. The ruble recovered after the 2008 crisis, but similar to other EM currencies has been in a downtrend since 2011. The recent lows exceed the 2008 lows – click to enlarge.

Stock Markets:

The Ukrainian UAX index, daily. The initial post revolution euphoria has given way to a pullback, but Ukrainian stocks are so depressed (especially in foreign currency terms) that they are probably a buy no matter what happens … – click to enlarge.