By IntrinsicValueFormulaÂ

How do normal investors like you and I invest in a bank? According to Warren Buffett, the answer is pretty simple. Look to the bank’s return on assets or ROA.

“Well, a bank that earns 1.3% or 1.4% on assets is going to end up selling above tangible book value. If it’s earning 0.6% or 0.5% on the asset, it’s not going to sell. Book value is not key to valuing banks. Earnings are key to valuing banks. Now, it translates to book value to some extent because you’re required to hold a certain amount of tangible equity compared to the assets you have. But you’ve got banks like Wells Fargo and USB that earn very high returns on assets, and they at a good price to tangible book. You’ve got other banks … that are earning lower returns on tangible assets, and they’re going to sell — they’re going to sell [for less].â€

The attraction of return on assets is its simplicity. It captures so much of the essence of a bank, without getting caught up in the complexity of the big bank accounting mess.

In our continuing series of discovering the formulas and ideas to value a bank or financial institution, we will discuss the return on assets or ROA.

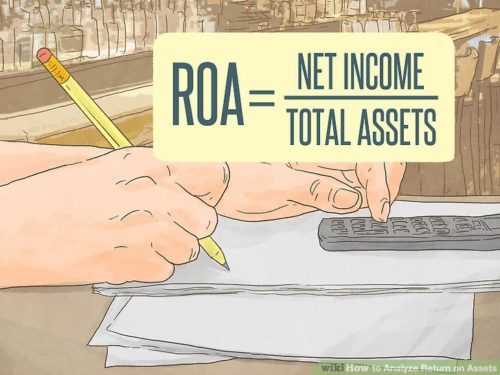

Definition of Return on Assets

So what is a return on assets?

According to Investopedia.

“Return on assets (ROA) is an indicator of how profitable a company is about its total assets. ROA gives an idea as to how efficient management is at using its assets to generate earnings.â€

This term is often referred to as return on investments or ROI.

Return on assets tells you what earnings were created from invested capital or assets. Return on assets can vary from the company and will be very dependent on the industry the company is in.

This is why when using return on assets as a comparative measure, it is best to compare it to companies previous ROA or the ROA of a similar company.

The assets comprise of debt and equity of a company, both of these types of financing are used to fund the operations of the company.

The return on assets figure gives the investors an idea of how effectively the company is converting the money it has to invest in income.

Obviously, the higher, the better because the company is earning more money on fewer invested dollars.

Management’s most important job is to make good choices when allocating its resources and the best managers are great capital allocators.

These allocators can create more assets from the assets they already have and create more income for the company from those assets.

How it impacts valuations of banks

When calculating return on assets for a bank, we need to remember that banks are highly leveraged, so a 1% ROA indicates huge profits.

The discrepancy catches a lot of investors off guard; you need to remember that this numbers should be used to compare itself to other banks, not a tech company.