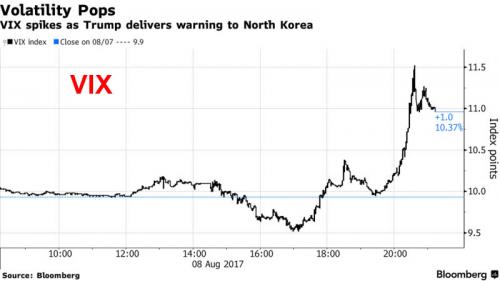

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday’s sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks. The Swiss franc gained 1.2 percent to 1.1320 per euro its biggest daily advance since February 2015, while the yen surged as much as 0.8% against per euro, its strongest level in three weeks while gold rose.

“Trump’s comments about North Korea have created nervousness and the fear is if the President really means what he said: “fire and fury”,” said Naeem Aslam, chief market analyst at Think Markets in London. “The typical text book trade is that investors rush for safe havens.”

Gold was headed for it’s largest gain this month while the yen and Swiss franc were the biggest advancers among G-10 currencies after President Donald Trump ratcheted up his rhetoric against North Korea. Treasuries and most European government bonds climbed amid the shift to safer assets, while almost every sector of the Stoxx Europe 600 Index fell and emerging markets equities were poised for the biggest drop since June 15. The rand extended losses after South Africa’s president survived a no-confidence vote.

Earlier on Tuesday, volatility from the U.S. to Japan rose after Trump said in response to a Washington Post report on North Korea’s nuclear capabilities that further threats from the country would be met with “fire and fury.†North Korea said it’s examining an operational plan for firing a ballistic missile toward Guam. The VIX jumped above the 200-DMA as equity markets continuously push lower. The financial sector lagged, while defensive healthcare sector outperforms; gold and crude were supported in tandem.

Â

The heightened geopolitical tensions between the US and North Korea dampened global risk sentiment, which snapped the DJIA’s streak of record closes and saw nearly all Asia-Pac bourses in negative territory. This was after US President Trump warned North Korea the US would respond to any threats with an unprecedented level of “fire and fury”, which spurred a response from North Korea that it was considering striking Guam with mid-to long-range missiles.

“Trump in his reactions is something new for all of us,†Geraldine Sundstrom, portfolio manager at Pimco Europe, said in an interview on Bloomberg TV. “Given the nature of the threats, given the players are new, it makes the situation a little bit unusual,†said Sundstrom, who recommended safe haven trades and minimizing risks through duration.As a result, global assets have slumped in a “classic, risk-off reaction” as Bloomberg puts it.

The MSCI EM Asia Index of shares slid the most in a month. “We’re seeing a bit of risk aversion due to concerns over North Korea,†said Dushyant Padmanabhan, a currency strategist at Nomura in Singapore. “Besides the geopolitics, the market will also be focused on the Friday’s U.S. CPI print and what clues that might give us on the path for inflation.â€

The Nikkei 225 (-1.3%) underperformed as exporters suffered from the flows into JPY. The Nikkei Stock Average Volatility Index soared as much as 38%, most since August 2015, with the VNKY Index closing +24% at 16.00. The Korean KOSPI (-1.1%) was also, so to say, “weighed down” by the increased threat of nuclear war. In retrospect, that the South Korean market dipped just over 1% on the prospect of a mushroom cloud, is rather impressive.

Hang Seng (-0.4%) and Shanghai Comp (-0.2%) were subdued following a miss on Chinese CPI and PPI data, while ASX 200 (+0.4%) bucked the trend amid gains in the metals-related stocks and with the largest-weighted financials sector buoyed after big-4 bank CBA reported an 8th consecutive year of record profits. Demand for 10yr JGBs was spurred by a flight to quality and with the BoJ in the market for JPY 770b1n of JGBs. The curve also slightly flattened amid outperformance in the long-end.

Elsewhere, the Stoxx Europe 600 Index declined 0.6 percent as of 9:54 a.m. in London, the largest drop in more than a week on a closing basis. The U.K.’s FTSE 100 Index declined 0.6 percent, the first retreat in a week. Germany’s DAX Index sank 1.2 percent in the biggest tumble in almost three weeks. Futures on the S&P 500 Index sank 0.4 percent, the largest decrease in almost five weeks. The MSCI Emerging Market Index sank 0.9 percent, the biggest dip in almost eight weeks.

“Heightened geopolitical risks overnight have seen the markets flip from risk-on to risk-off and we have to wait and see how long this move runs before adding some positions,” said Viraj Patel, an FX strategist at ING in London.

In overnight FX trading, risk aversion dominated trading as the Swiss franc and the yen led gains among Group-of-10 currencies, while the dollar index steadied as EM currencies halted a three-day rally. The yen appreciated as much as 0.8 percent to 128.61 per euro, its strongest level in three weeks. During previous occasions of political turmoil between the U.S. and North Korea, the Japanese currency over performed, yet the Swiss franc’s sharp decline in the past two weeks made for stretched positioning versus the euro, resulting in a bigger gain. The Australian dollar and New Zealand dollar both weakened.South Korea’s won fell to a three-week low amid heightened geopolitical tensions over North Korea.

CNH and CNY both rally through 6.70/USD, highest since October 2016 after another stronger PBOC fixing. Core fixed income gains sharply, curves bull flatten with heavy volume noted in USTs. VIX jumps above 200-DMA as equity markets continuously push lower. Financial sector lags, while defensive healthcare sector outperforms; gold and crude supported in tandem.

Some remain skeptically optimistic: at the moment the tensions increasing around North Korea’s nuclear weapons program does remain an “exchange of rhetoric,†and under normal expectations it’s difficult to think that any “real action†will be taken from here, says Takuya Yamada, a senior money manager in Tokyo. •If something actually happens, it won’t be surprising to see the market fall 5%, 10% in no time at all. However investors are aware of the fact that if North Korea takes action it will mean self- destruction, so their premise is that this is merely “trash talking.â€