The Federal Reserve has been gradually raising its target interest rate (the “federal funds interest rate) for about two years, since early 2016. This increase has been accompanied by a controversy that I think of as a battle of metaphors. By raising interest rates, is the Fed stepping on the brakes of the economy? Or is it just easing off on the accelerator pedal?

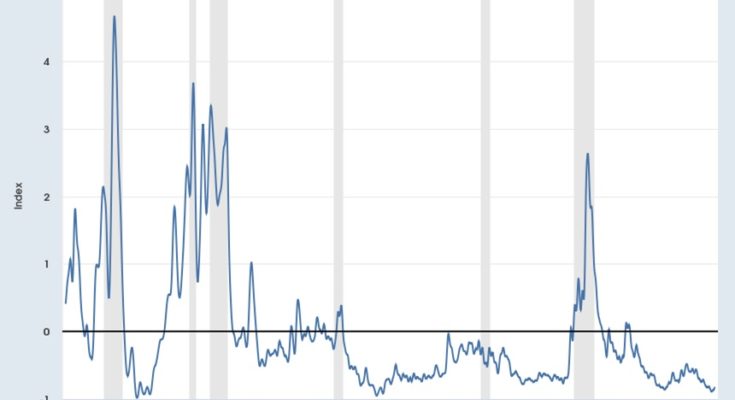

To shed light on this controversy, it would be useful to to have a measure of financial conditions in the US economy that doesn’t involve one specific interest rate, but instead looks at actual factors like whether credit is relatively available or not, whether leverage is high or low, and whether those who provide loans are able to raise money with relatively low risk. Fortunately, the Federal Reserve Bank of Chicago has been putting together a National Financial Conditions Index based on exactly these components. Here’s a figure of the data going back to the 1970s.