Image Source:

Image Source:

We expect a consensus 25bp rate cut this week in Sweden. Despite a soft start to the fourth quarter for GDP, forward-looking activity indicators are signaling that rate cuts are turning the tide for the Swedish economy, and we expect the Riksbank’s terminal rate at 2.0% – above that of the ECB. This can favor a moderately lower EUR/SEK in 2025.

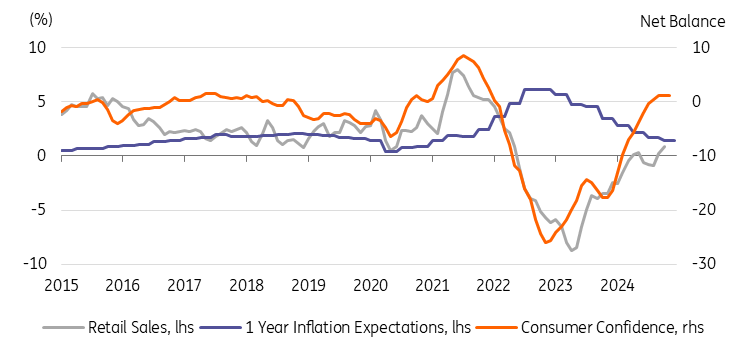

A bit more fuel to support the activity reboundUntil last week, Sweden’s central bank was tied with the Bank of Canada in the race to cut rates the farthest in 2024. The Riksbank cut rates by 50 basis points in November alone and we expect a further 25bp move to 2.5% this week, in line with consensus.Those rate cuts are bearing fruit. Remember Sweden’s mortgage market is heavily based on floating-rate lending. That meant rate hikes hit the economy harder and more rapidly than elsewhere. But now rates are falling again, sentiment in the property market has rebounded, transactions are up and house prices are rising at almost 8% year-on-year. Consumer confidence has surged this year and is back to pre-Covid levels.The jobs market has stabilized too. Sweden’s unemployment rate, though volatile, appears to have stopped rising. Redundancy levels have leveled out, albeit a little above what was typical pre-Covid.None of that means the Riksbank is in a position to stop cutting rates just yet, though the end of the cutting cycle may not be far away.Growth, judging by the official GDP data, has been fairly lackluster. The most recent data on household consumption was weak, despite that improvement in sentiment. And while the recent run of inflation data has been hotter than the Riksbank had expected in its September forecasts, there’s little reason to expect a material uptick in 2025. Going into spring wage talks, both employer and employee inflation expectations look pretty tame. That points to an outcome that’s fairly consistent with the Riksbank’s 2% inflation target.Add in the risks from Donald Trump’s trade war for Sweden’s relatively export-orientated economy, and we think there’s scope for both a cut this week and two more next year, ultimately taking the policy rate to 2%. We expect that path to be largely reflected in the Riksbank’s updated interest rate projection this week.An improving outlook for Sweden Source: ING, Macrobond

Source: ING, Macrobond

Krona’s stability looks here to stayEUR/SEK one-month historical volatility has plummeted since mid-November, and is now at three-year lows. We believe this is the consequence of a similar risk premium attached to SEK and EUR when it comes to Trump’s protectionist agenda as well as the relative predictability of the Riksbank and the European Central Bank’s rate cutting cycles.We have held a neutral short-term view around the 11.50 mark for the pair since the US election, and we suspect that this week’s Riksbank announcement shouldn’t have major FX implications. However, looser monetary policy in Sweden is starting to show beneficial signs for domestic activity, allowing markets to anchor the Riksbank’s terminal rate expectations to 2% while those on the ECB have been repriced markedly lower. This is mirrored by a EUR:SEK two-year swap rate differential back at zero after having peaked above 40bp in late August.If the prospect of larger ECB cuts compared to the Riksbank proves true, there will be a compelling argument for a structural shift to lower trading range in EUR/SEK. That said, the higher beta of SEK to market sentiment still puts a floor on how far EUR/SEK can drop in what we expect to be turbulent time for the currencies of open economies under Trump 2.0. In our current assessment, that floor should be 11.00, and our mid-year 2025 EUR/SEK forecast is 11.30.More By This Author:Bank Of England Rates To Stay On Hold But Cuts To Accelerate In 2025 FX Daily: Euro Area PMIs To Set The Tone A Christmas Pantomime

Riksbank Preview: Another Cut On The Path To 2%