The Reserve Bank of Australia once again left its interest rate at record low of 1.5 percent, citing low inflation rate, low growth in labour costs and strong retail competition.

According to the central bank, while the recent inflation data were in line with the bank’s expectations, inflation is likely to remain low in the near term due to weak wage growth and strong price competition in the retail industry.

However, the apex bank believes record-low interest rate will support the Australian economy and reduce unemployment rate even more while giving inflation the needed support towards its 2 percent target.

Despite steady job creation, strong commodity prices and growing Chinese economy amid improved global economic outlook, the central bank is finding it hard to substantially boost prices and curb retail price competition due to low demand and weak wage growth.

But with the Chinese economy, Australia’s largest trading partner, projected to slow towards the end of the year as credit control measures filtered through key sectors, the Australian economy may struggle even more, especially if the Fed raised rates as projected.

Still, the apex bank said low wage growth is likely to continue for awhile but hopeful that tight labour market will eventually force employers to start raising wages.

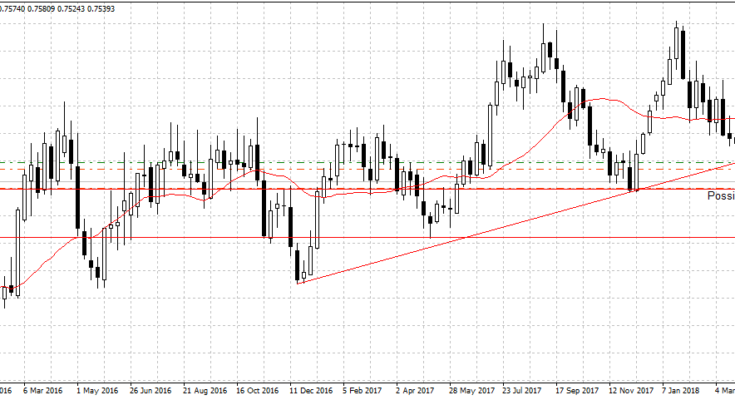

The Australian dollar gained slightly against the US dollar on Tuesday, that is partly because of the closed Chinese market. However, the price remained below the ascending channel as shown below and expected to dip even further towards the 0.7332 support level low inflation rate,.

According to RBA, “An appreciating exchange rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecast.”