Early in November, the United States elected perhaps one of the most controversial political candidates to become the 45th President, with Donald Trump. To many, the results were quite shocking. In fact, overnight Dow Jones Industrial stock futures dropped over 800 points, but by morning, the market had recovered. Â Financial stocks rallied on the promise of Trump’s Administration cutting the red tape and bonds dropped on the expectation of future inflation.

All the optimism in the financial markets is not without a lot of anxiety, however. Â One of Trump’s many campaign promises was that he would repeal Dodd-Frank. In the days following the election, a slew of politicians are vowing to fight against any repeal of Dodd-Frank. They are calling it a step backward.

But, what does the data say?

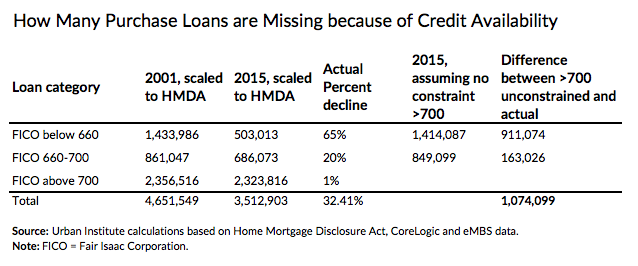

The left-leaning Urban Institute recently published an analysis of the mortgage market. They found that there are millions of missing loans due to a tight credit box. In fact, the total number of missing loans in 2015 was about 1.1 million, per their analysis. A previous analysis showed similar results in every year since the Financial Crisis of 2009. Last year, the Mortgage Bankers Association reported that the average purchase loan size was $294,900. So, by simple math, that indicates that about $317 billion was missing from mortgage lending volume in 2015 alone.

Some may look at the table above and immediately think, “Well, maybe that’s a good thing because those borrowers not getting loans have the lowest credit scores.” Â That’s a true enough assessment by itself, but take a look at the next chart. This shows the U.S. home ownership rate from 1965 to the present.

(Click on image to enlarge)

Home ownership rates are currently at historically low levels. This is a startling fact, considering that interest rates are also at record low levels. It has never been cheaper for an American to take on the dream of home ownership. This has been a primary method of wealth creation for many Americans since the Great Depression. It was during the Great Depression that Fannie Mae (FNMA) was created as part of the New Deal era of progressive policies that were intended to promote financial stability and a strong middle class. It was in 1968 that Fannie Mae was actually privatized. This brought forth a new era of increasing home ownership. Â It wasn’t until recently that home ownership formed in a housing finance bubble that eventually popped.