Pressure continues to build on the ECB to act. As discussed earlier (see post), the central bank may remain on the sidelines for some time, but the latest developments (listed below) make this inaction increasingly difficult.

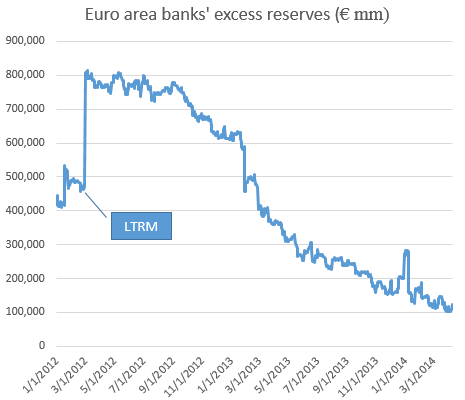

1. Declines in liquidity have been quite sharp. The Eurozone banks’ excess reserves are still declining, touching the levels not seen in years.

Â

|

| Source: ECB |

2. The French inflation report that came out today shows price increases that are materially below the central bank’s target (see chart) and seem to be trending lower. Disinflationary risks remain.

3. The euro is grinding higher, which is not great for the area’s exporters and will put further downward pressure on prices.

Â

|

| EUR/USD (source: MarketWatch) |

4. China’s slowdown will also have a negative impact on the area’s economy because China represents the Eurozone’s third largest export market outside of the EU. The fact that China’s imports unexpectedly fell by 11% is not great news for the euro area’s recovery.

Â

|

| Source: Investing.com |