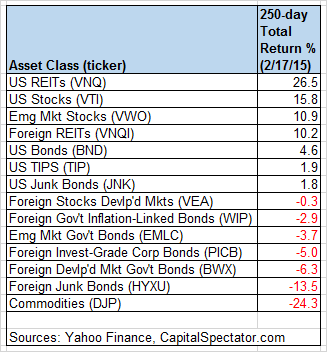

Real estate investment trusts (REITs) continue to hold the pole position among the major asset classes for the trailing one-year period, although the sizzling returns of late have cooled a bit in recent weeks. Vanguard REIT (VNQ) is higher by a strong 26.5% on a total return basis through yesterday (Feb. 17), based on the trailing one-year period (defined here as the past 250 trading days). That’s an impressive gain, but it’s moderately softer than the advances we’ve seen earlier this year.

Meantime, commodities broadly defined are still wallowing in last place among the major asset classes via our standard list of exchange-traded products. The iPath Bloomberg Commodity Index ETN (DJP) retains the title of the worst performer over the past 250 trading days, tumbling 24.3% through yesterday’s close. But the losses are no longer deepening, courtesy of this month’s modest rally off the bottom. It’s unclear if this is a revival with legs or just intermission before the next leg down. For the moment, however, commodities are displaying something we haven’t seen in this corner for a while: a touch of positive momentum.

Here’s a graphical recap of the relative performance histories for each of the major asset classes for the past 250 trading days via the ETF proxies. The chart below shows the performance records through Feb. 17, 2015, with all the ETFs rebased to a starting-value of 100. Despite the recent setback for REITs (dark blue line at top of chart below), a sharp divergence is still conspicuous relative to rest of the field.

Now let’s review an ETF-based version of an unmanaged, market-value-weighted mix of all the major asset classes — the Global Market Index Fund, or GMI.F, which holds all the ETFs in the table above. Here’s how GMI.F stacks up for the past 250 trading days through Feb. 17, 2015. This investable strategy is ahead by a modest 5.8% over that span — well below the performance for US stocks (VTI) while moderately above the return for US bonds (BND).